Buy Now, Pay Later: The Next Phase of Flexible Finance

Photo by CardMapr.nl on Unsplash

Introduction: The Rise of Buy Now, Pay Later

Buy Now, Pay Later (BNPL) finance models have transformed the global payments landscape by allowing consumers to split purchases into smaller, often interest-free installments. This approach is not only about convenience, but also about financial flexibility , making higher-value items more accessible to a broader demographic. As of 2025, the global BNPL market is projected to reach $560.1 billion, reflecting a 13.7% annual growth rate . Notably, over half of U.S. consumers are expected to have used a BNPL service at least once by the end of the year, with even higher adoption rates among Gen Z and Millennials [1] .

Current Adoption and Demographic Trends

BNPL is most popular among younger generations, with 59% of Gen Z and 58% of Millennials in the U.S. reporting use of these services in 2025. In the UK and Australia, 42% and 37% of adults, respectively, have utilized BNPL for online purchases, demonstrating the global reach of the model. The average BNPL transaction size stands at approximately $142, with options to spread payments over several months for larger purchases [1] .

Consumer preferences in BNPL skew toward technology and home goods. For instance, BNPL users are 44% more likely to buy Sony PlayStation products and 23% more likely to purchase Apple devices. In the appliance sector, a notable shift towards private-label brands is also evident, as users seek value and flexibility [3] .

Market Evolution: Challenges and Regulatory Shifts

While BNPL models surged in popularity during the pandemic, 2025 marks a period of recalibration. The cost of borrowing has risen, making it more expensive for providers to operate. This shift, coupled with record-high U.S. household debt ($18.2 trillion), has led to increased scrutiny from regulators and a greater focus on risk management. As a result, some leading BNPL companies are adjusting their business strategies to adapt to these changes [2] .

For merchants, this means that the once straightforward integration of BNPL tools may require more nuanced strategies. As some shoppers miss payments and regulatory bodies introduce new guidelines, businesses need to keep abreast of policy changes and ensure their checkout processes remain compliant and consumer-friendly [2] .

BNPL and Payment System Modernization

The future of BNPL is closely tied to broader trends in payment modernization. Real-time transaction capabilities are increasingly being integrated into BNPL offerings, enhancing convenience for consumers and operational efficiency for businesses. This immediacy is especially appealing to tech-savvy shoppers who value fast, frictionless transactions. From a business perspective, adopting modern payment systems can improve liquidity and reduce the reliance on interim credit facilities [5] .

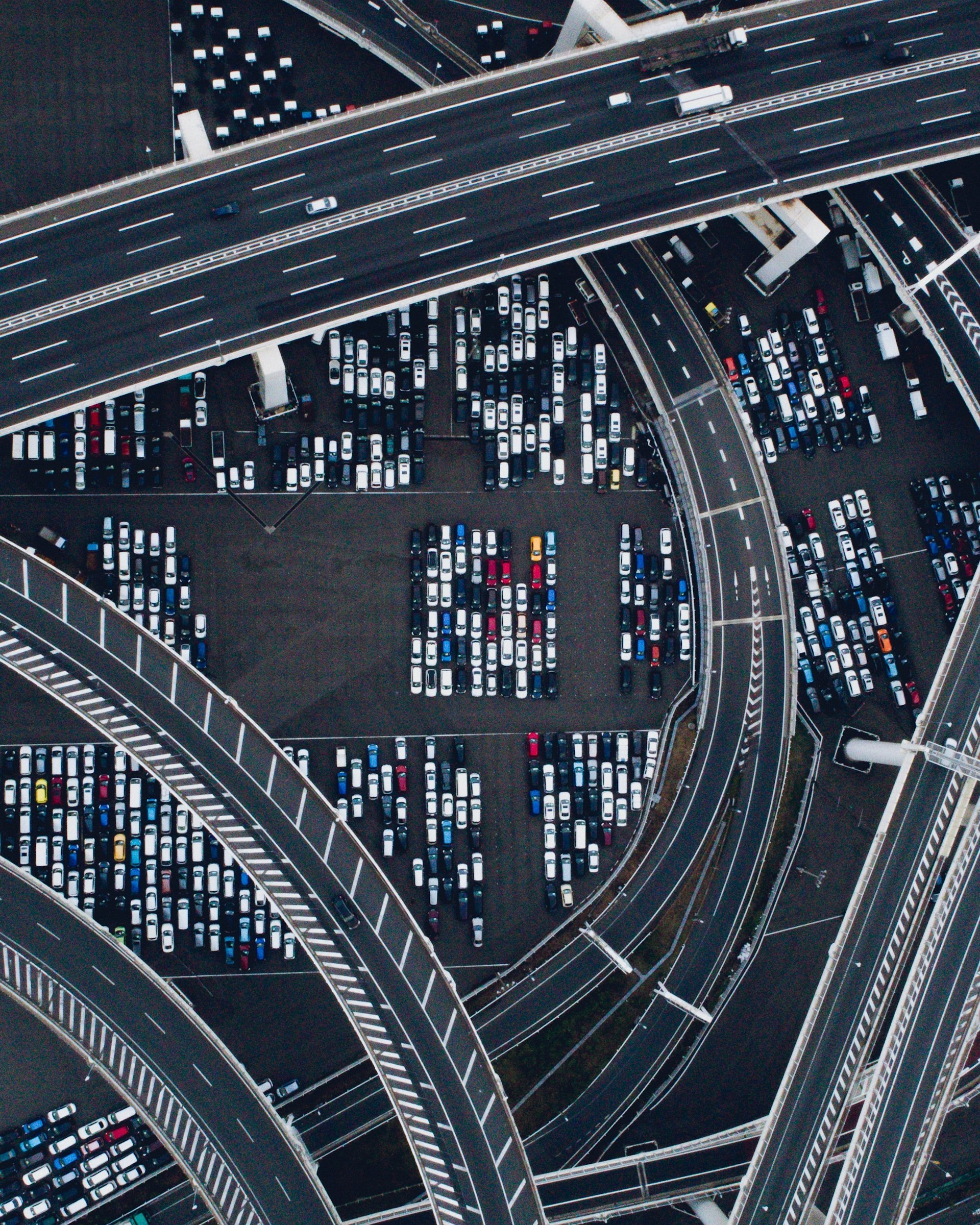

Photo by Arthur A on Unsplash

Businesses looking to implement or expand BNPL should:

- Evaluate payment providers that offer real-time settlement and robust fraud prevention.

- Stay informed on regulatory updates in their operating regions.

- Monitor consumer feedback to refine the BNPL experience and minimize missed payments.

Key Consumer Concerns and How to Address Them

Despite its popularity, BNPL is not without criticism. The most common consumer concerns include:

- Interest or late fees: 41% of potential users worry about unexpected costs.

- Overspending and budgeting: 32% fear exceeding their financial limits.

- Tracking payments: 13% are concerned about losing track of installment schedules [3] .

To address these issues, merchants and BNPL providers are increasingly offering transparent fee structures, user-friendly dashboards, and payment reminders. Businesses can encourage responsible usage by providing educational resources and integrating budgeting tools within their platforms.

How to Access BNPL Services and Opportunities

If you are a consumer interested in using BNPL options, you can typically access these services at checkout on major e-commerce platforms or through dedicated BNPL apps. Common providers include Affirm, Afterpay, Klarna, and PayPal. To get started, select BNPL as your payment method during checkout and follow the on-screen instructions, which usually involve a quick approval process and a breakdown of your repayment schedule. It’s important to review the terms, fees, and repayment dates carefully before committing.

For businesses, integrating BNPL can be achieved through your e-commerce platform’s payment settings or by partnering directly with a BNPL provider. Most major providers offer plugins or APIs for seamless integration. Before selecting a provider, consider:

- The range of supported payment structures (e.g., pay-in-four, longer-term plans)

- Fee schedules and merchant costs

- Customer service and support capabilities

- Regulatory compliance and data security features

As regulations evolve, businesses should also regularly review their BNPL offerings to ensure continued compliance and consumer trust.

Potential Challenges and Alternative Approaches

Despite the advantages, BNPL models present several challenges. Higher interest rates and increased regulatory scrutiny may impact availability and terms, while consumer debt levels rise. To mitigate these risks, businesses may explore alternative financing models, such as:

- Traditional installment loans: Offered through banks or credit unions, these can provide structured repayment but often come with interest charges.

- Credit card installment plans: Some credit card issuers offer flexible payment programs for larger purchases.

- Layaway programs: Allow consumers to reserve items and pay over time before receiving the product, reducing the risk of missed payments.

Consumers seeking alternatives should compare terms, fees, and approval criteria to select the most suitable payment method for their needs. If you encounter difficulties or uncertainties, consider consulting with your financial institution or a certified credit counselor for personalized advice.

Emerging Trends and the Future Outlook

The future of BNPL lies in ongoing innovation and adaptation. Technologies such as artificial intelligence, embedded finance, and real-time payments are expected to further streamline the user experience. As businesses and regulators continue to balance consumer protections with innovation, the BNPL model could become even more integrated into everyday financial life [5] .

For those interested in staying ahead of these developments:

- Monitor updates from the Consumer Financial Protection Bureau (CFPB) and similar regulatory agencies.

- Engage with trade associations and e-commerce forums to learn about best practices.

- Experiment with different BNPL providers and payment models to find the best fit for your business or personal needs.

Ultimately, the evolution of BNPL finance models presents opportunities for greater financial inclusion and e-commerce growth, but also demands careful management and consumer education.

References

- CoinLaw (2025). Buy Now, Pay Later Statistics 2025: Trends and Insights.

- MAK Digital Design (2025). Buy Now Pay Later in 2025: What Every Merchant Should Know.

- Numerator (2025). Insights Into Buy Now, Pay Later: Growth & Trends 2025.

- Consumer Financial Protection Bureau (2025). Consumer Use of Buy Now, Pay Later and Other Unsecured Debt.

- Echo Health (2025). The Future of Payments in 2025: Modernization in The US.