Emerging Strategies Shaping the Future of Impact Investing

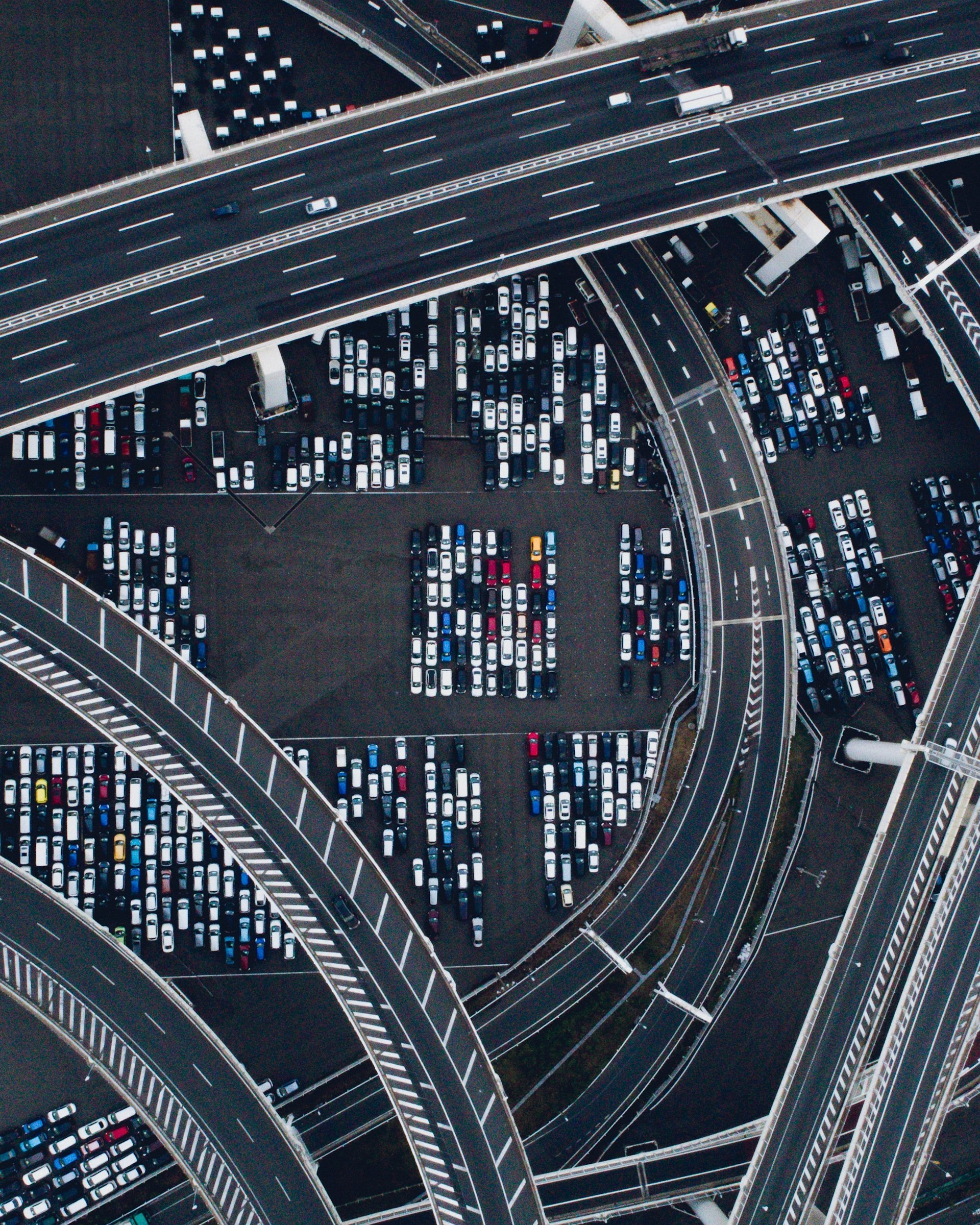

Photo by lonely blue on Unsplash

The Evolution and Promise of Impact Investing

Impact investing has rapidly matured from a niche movement into a powerful force for delivering both financial returns and positive societal and environmental outcomes. With over $1 trillion USD now earmarked for impact investments globally, the strategies and expectations for this sector are evolving at an unprecedented pace. As we approach the mid-2020s, investors, fund managers, and social entrepreneurs must navigate new opportunities, heightened scrutiny, and shifting global priorities. The following sections detail the most significant strategies, trends, and actionable pathways for engaging with the future of impact investing, ensuring you can participate in meaningful, measurable change while pursuing competitive returns.

Thematic Impact Funds: Aligning with Global Challenges

Thematic impact funds have risen to prominence as a direct response to the demand for investments that target specific global challenges such as climate resilience, social equity, and economic inclusivity. These funds allow investors to concentrate their capital on areas of personal or institutional priority, such as renewable energy, affordable housing, or healthcare innovation. Thematic alignment not only clarifies the fund’s purpose but also helps attract like-minded capital and partners who share similar values and objectives [1] .

For example, a fund focused on climate resilience might allocate resources to companies developing energy-efficient technologies, while a social equity fund could back affordable housing projects or workforce development programs in underserved communities. The key to success in thematic investing is the availability and reliability of impact data. Investors should seek out funds that provide transparent, third-party verified metrics and are committed to ongoing measurement and reporting.

Getting Started: To access thematic impact funds, you can:

- Consult with an investment advisor specializing in sustainable and impact finance.

- Search for funds listed by established databases such as the Global Impact Investing Network (GIIN).

- Attend industry conferences or webinars to connect with fund managers and learn about new offerings.

Potential challenges include the risk of “impact washing”-where funds claim impact without delivering measurable results. To mitigate this, prioritize funds that adhere to rigorous standards and have a track record of independent verification [5] .

Scaling through Catalytic Capital

Catalytic capital is investment that accepts disproportionate risk or concessionary returns to unlock new markets, attract additional investment, or support high-impact solutions that might otherwise struggle to scale. This strategy has become mainstream as leading funds recognize that innovative, flexible capital structures can deliver outsize social and environmental benefits while paving the way for follow-on commercial investment [4] .

Examples include early-stage backing for social enterprises, blended finance vehicles combining public and private funds, and guarantees or first-loss positions that reduce risk for mainstream investors. The

Collaborate for Impact

initiative, for instance, has mobilized significant capital for social enterprises by combining resources from multiple stakeholders and lowering barriers for future investors.

Action Steps:

- Join communities of practice or professional networks focused on catalytic capital.

- Engage with impact funds that openly describe their capital structure and risk-return expectations.

- Leverage public-private partnerships to access blended finance opportunities, often available through government development agencies or multilateral development banks.

Challenges with catalytic capital often center on aligning expectations across diverse stakeholders and ensuring transparent risk-sharing. Clear communication and well-defined impact objectives are essential for sustainable collaboration.

Alternative Assets: Real Assets and Patient Capital

Investors seeking resilient, long-term impact increasingly look to real assets such as sustainable forestry, regenerative agriculture, and clean energy infrastructure. These assets generate returns through operational improvements and resource management rather than financial engineering, offering both financial outperformance and direct environmental benefits [5] .

Community development financial institutions (CDFIs) and social impact bonds represent innovative models in this space, linking financial returns directly to the achievement of social outcomes. Investors willing to commit patient capital-funds invested for longer periods than typical market cycles-can take advantage of less efficient markets and help drive systemic change.

Implementation Guidance:

- Identify asset managers specializing in real asset impact investments via industry directories or professional referrals.

- Review available offerings for their alignment with Sustainable Development Goals (SDGs) and the presence of third-party impact verification.

- Consider direct investment in projects or enterprises that align with your values and time horizon.

Potential risks include liquidity constraints and longer timeframes for realizing returns. Investors should balance their portfolio with both liquid and illiquid assets according to their risk tolerance and investment goals.

Technological Innovation and Venture Capital

The future of impact investing will be shaped significantly by technological innovation. Growth equity and venture capital now offer direct exposure to transformative technologies, including artificial intelligence, automation, and climate tech. According to recent industry research, enterprise spending on AI is expected to grow at an annual rate of 84% over the next five years, opening up fresh opportunities for investors to back startups addressing societal and environmental challenges [2] .

Many impact-focused funds now prioritize companies developing new solutions for renewable energy, fintech for inclusion, or healthcare access. The evolving venture landscape also means that entry-point valuations have decreased from their 2021 peaks, offering potential for improved returns while supporting innovation.

Actionable Steps:

- Engage with established venture capital firms that have a track record in impact sectors.

- Utilize industry events to connect with emerging founders and assess new technologies.

- Review due diligence resources from trusted organizations like the Global Impact Investing Network for best practices in evaluating impact startups.

Challenges include high competition for deals and the inherent risk of early-stage investments. To mitigate these, diversify across sectors and stages, and seek guidance from reputable advisors.

Impact Integrity and Measurement

As the field matures, the need for authenticity and robust impact measurement has never been greater. Preventing “impact washing”-where investments are marketed as impactful without delivering real outcomes-is a top priority. The development of rigorous standards and third-party verification is helping to ensure that impact claims are credible and outcomes are measurable [5] .

Leading funds and organizations now report on their alignment with established frameworks such as the Impact Management Project, GIIN’s IRIS+ metrics, and the UN SDGs. Investors should demand regular, transparent reporting and seek evidence of third-party audits or certifications.

Steps to Ensure Impact Integrity:

- Ask for detailed impact reporting and third-party verification before investing.

- Review the alignment of funds or projects with widely accepted standards.

- Participate in industry initiatives promoting transparency and accountability, such as those led by GIIN or the Impact Management Project.

The challenge is distinguishing between genuine impact and marketing claims. Always seek documentation, question assumptions, and consult independent reviews where available.

Photo by Nick Chong on Unsplash

Addressing Systemic Risks and Focusing on Inclusion

Impact investing is increasingly recognized as a critical tool for addressing systemic risks such as climate change, biodiversity loss, and social inequality. The sector is also seeing renewed focus on supporting the working class and poor by improving access to quality jobs, affordable housing, and financial inclusion [3] .

Investors are encouraged to look to emerging markets, where demographic and economic transitions offer significant impact potential. Supporting worker-owned businesses, rural infrastructure, and inclusive finance in developing regions are among the strategies gaining traction.

How to Get Involved:

- Seek funds and projects with clear, locally relevant impact objectives.

- Engage with community development finance institutions and social enterprises operating in your regions of interest.

- Leverage resources and networks provided by established organizations, including the GIIN and local development agencies.

Challenges may include navigating regulatory differences and understanding local contexts. Diligent research and partnership with trusted local organizations can bridge these gaps.

Getting Started and Next Steps

To participate in the future of impact investing, consider the following steps:

- Clarify your impact priorities and values, aligning them with established themes or SDGs.

- Research funds and opportunities through professional advisors, established industry databases, and by attending relevant conferences or webinars.

- Assess fund transparency, measurement standards, and evidence of impact integrity before committing capital.

- Engage in industry networks to stay informed about emerging trends and opportunities.

- For direct investment, review local regulations and consider partnerships with experienced organizations to mitigate risk.

If you are interested in learning more or connecting with impact investment professionals, you can find resources and directories through the Global Impact Investing Network (GIIN) and similar trusted organizations. For tailored advice, consult with a certified financial advisor specializing in sustainable and impact investing. Remember, the field continues to evolve, and staying informed is key to maximizing both financial and societal returns.

References

- Upmetrics (2025). 2025 Impact Investing: Key Trends, Opportunities and Strategies.

- J.P. Morgan Private Bank (2025). Alternative Investments in 2025: Our top five themes to watch.

- Global Impact Investing Network (2025). Seven things to watch in impact investing in 2025.

- Impact Europe (2025). How impact funds are scaling in 2025.

- CAIA Association (2025). The Evolution of Impact Investing: Aligning Financial Returns with Positive Change.