Essential Strategies for Financial Planning in Unexpected Crises

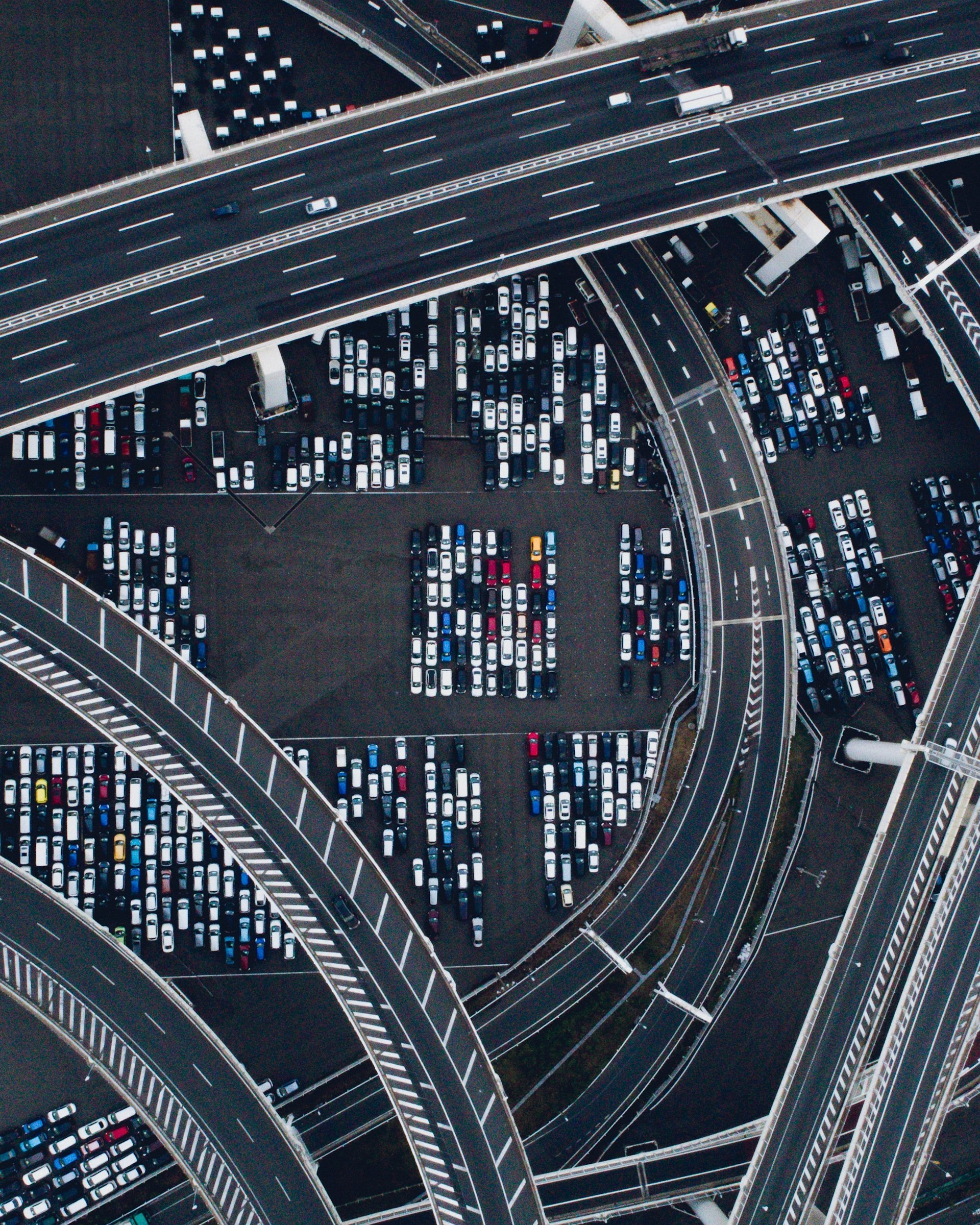

Photo by Jakub Żerdzicki on Unsplash

Introduction: The Importance of Financial Planning for Unexpected Crises

Unexpected crises-whether personal, economic, or natural-can strike at any moment. Without a solid financial plan, such events often result in long-term hardship, stress, and delayed recovery. However, by anticipating risks and preparing in advance, you can protect your financial stability and ensure a faster, more confident return to normalcy. This article provides comprehensive, actionable guidance on how to prepare for financial shocks, access resources, and build lasting resilience in the face of uncertainty [1] .

1. Building a Resilient Financial Foundation

Establishing a strong financial base is the first step in preparing for the unexpected. This involves:

- Setting Clear Financial Goals: Define your priorities-such as maintaining your lifestyle, supporting family, or protecting assets. Knowing your objectives helps align your financial decisions with your long-term vision [1] .

- Monitoring Cash Flow: Regularly track all income and expenses. Use budgeting tools or simple spreadsheets to identify spending patterns and areas where you can cut costs or increase savings [2] .

- Minimizing Debt Risk: Aim to reduce high-interest debts and only take on loans that serve a strategic purpose. Maintaining good credit ensures you can access funds if emergencies arise [1] .

Example:

After a job loss, a family with an emergency fund and minimal credit card debt was able to cover living expenses for six months, avoiding high-interest borrowing and additional stress.

2. Emergency Savings: Your First Line of Defense

An emergency fund is a liquid, accessible reserve set aside specifically for unforeseen expenses. Most experts recommend saving enough to cover three to six months of living costs, but the amount should reflect personal factors like job security, dependents, and health considerations [2] [3] .

How to Build an Emergency Fund:

- Open a separate savings account for emergencies.

- Set up automatic transfers from your checking account.

- Start with small, regular contributions-even $25 per week can add up over time.

- Replenish the fund after any withdrawal.

Alternative Approaches: If saving a large lump sum seems impossible, focus on incremental growth. Some households use tax refunds, bonuses, or side income to boost their fund.

Real-World Challenge:

Natural disasters often disrupt ATM and card access. Keep a small amount of cash in a secure place at home for immediate needs

[3]

.

3. Insurance: Protecting Yourself from Major Setbacks

Insurance is a crucial but often overlooked part of crisis planning. The right policies can shield you from catastrophic financial losses due to health emergencies, accidents, or property damage.

Key Types of Insurance to Consider:

- Health insurance: Covers medical emergencies and serious illnesses. Review your policy annually and consider an HSA (Health Savings Account) or FSA (Flexible Spending Account) to save pre-tax for out-of-pocket costs [2] .

- Homeowners/renters insurance: Protects against damage to your residence. Be aware that standard policies may not include flood or earthquake coverage; check if you need separate policies [3] .

- Life and disability insurance: Provides financial security for your loved ones or yourself if you cannot work due to illness or injury [4] .

Example:

After a flood, a homeowner with comprehensive property and flood insurance quickly accessed funds for repairs, while uninsured neighbors faced long delays and significant out-of-pocket expenses.

4. Accessing Cash and Credit During a Crisis

Crisis situations often require immediate access to funds. Maintaining a mix of cash and available credit can make all the difference.

- Cash: Keep enough on hand for several days’ expenses, but avoid storing large sums at home for security reasons.

- Credit: A home equity line of credit (HELOC) or personal credit line can provide emergency liquidity without disrupting long-term investments. Use credit cautiously and only for true emergencies [5] .

If You Need Immediate Help: During large-scale disasters, local banks may offer short-term relief options. Contact your bank to ask about disaster assistance programs or short-term forbearance if you’re unable to make payments.

5. Organizing Vital Records and Financial Documents

Quick access to key documents is essential for crisis recovery. Gather and securely store:

- Identification (passports, driver’s licenses, Social Security cards)

- Insurance policies

- Bank and investment account details

- Property deeds, titles, and lease agreements

- Medical records

Make digital backups on an encrypted drive or secure cloud service. Consider keeping paper copies in a fireproof, waterproof safe. The Emergency Financial First Aid Kit (EFFAK) is a highly recommended resource for organizing these materials; you can download it from the official Ready.gov website [3] .

6. Addressing Common Crisis Scenarios: Medical, Job Loss, and Disaster

Medical Emergencies: Even with insurance, out-of-pocket costs can be significant. Review your health coverage annually and consider supplemental insurance if you have chronic conditions. If faced with large bills, contact your provider to discuss payment plans or financial assistance programs [2] .

Job Loss: Unemployment can be sudden and overwhelming. To prepare, identify alternative income sources in advance-such as freelance work, part-time jobs, or rental income. If laid off, apply for state unemployment benefits immediately by visiting your state’s official unemployment portal or Department of Labor website. You may also qualify for job training or reskilling programs through local workforce development agencies.

Photo by Ivan Shilov on Unsplash

Natural Disasters: Ensure you have adequate insurance coverage and keep emergency cash accessible. After a disaster, contact your insurance agent to start a claim and reach out to local relief agencies for immediate support. For federal assistance, search for disaster relief programs through FEMA (Federal Emergency Management Agency) and your state’s emergency management office.

7. Estate and Legacy Planning

Unexpected crises can impact not just your finances but also your family’s future. An up-to-date estate plan-which may include a will, power of attorney, and medical directives-ensures your wishes are followed even if you are unable to communicate them [1] .

Consult with a licensed estate attorney or financial advisor to draft these documents. If you need help finding one, contact your local bar association or search for “estate planning attorney near me.”

8. Protecting Against Scams and Fraud During a Crisis

Scammers often prey on people during crises. Be vigilant:

- Don’t share personal financial information with unknown callers or emails.

- Use only official websites for government programs and benefits. If unsure, search for the official agency (such as the IRS, FEMA, or your state’s Department of Insurance).

- If you receive suspicious messages claiming to be from the government, report them to the Federal Trade Commission at ftc.gov/complaint [3] .

9. Step-by-Step Guide to Strengthening Your Financial Resilience

- Assess your current financial situation and set clear, realistic goals.

- Create or update your monthly budget to include emergency savings.

- Review and adjust insurance coverage annually.

- Organize and securely store all critical financial documents.

- Identify and prepare for likely crisis scenarios (health, job loss, natural disaster).

- Establish or expand your network of support: financial advisor, insurance agent, and local relief agencies.

- Update your estate plan and communicate your wishes to family members.

- Stay alert for financial scams and report suspicious activity promptly.

If you need immediate help or don’t know where to start, consider contacting a certified financial planner (search via the CFP Board’s official website) or your local nonprofit credit counseling agency for free or low-cost guidance.

References

- [1] Carson Wealth (2023). Crisis Management Financial Planning: Preparing for Unexpected Events.

- [2] MoneyFit (2023). Planning for Unexpected Expenses: How to Be Financially Ready.

- [3] Ready.gov (2025). Financial Preparedness.

- [4] BIP Wealth (2023). How to Financially Plan for Unexpected Life Events.

- [5] Cerity Partners (2023). Financial Preparedness for Emergencies: A Guide for High-Net-Worth Families.