How AI Is Transforming Algorithmic Trading Efficiency: Strategies, Benefits, and Implementation

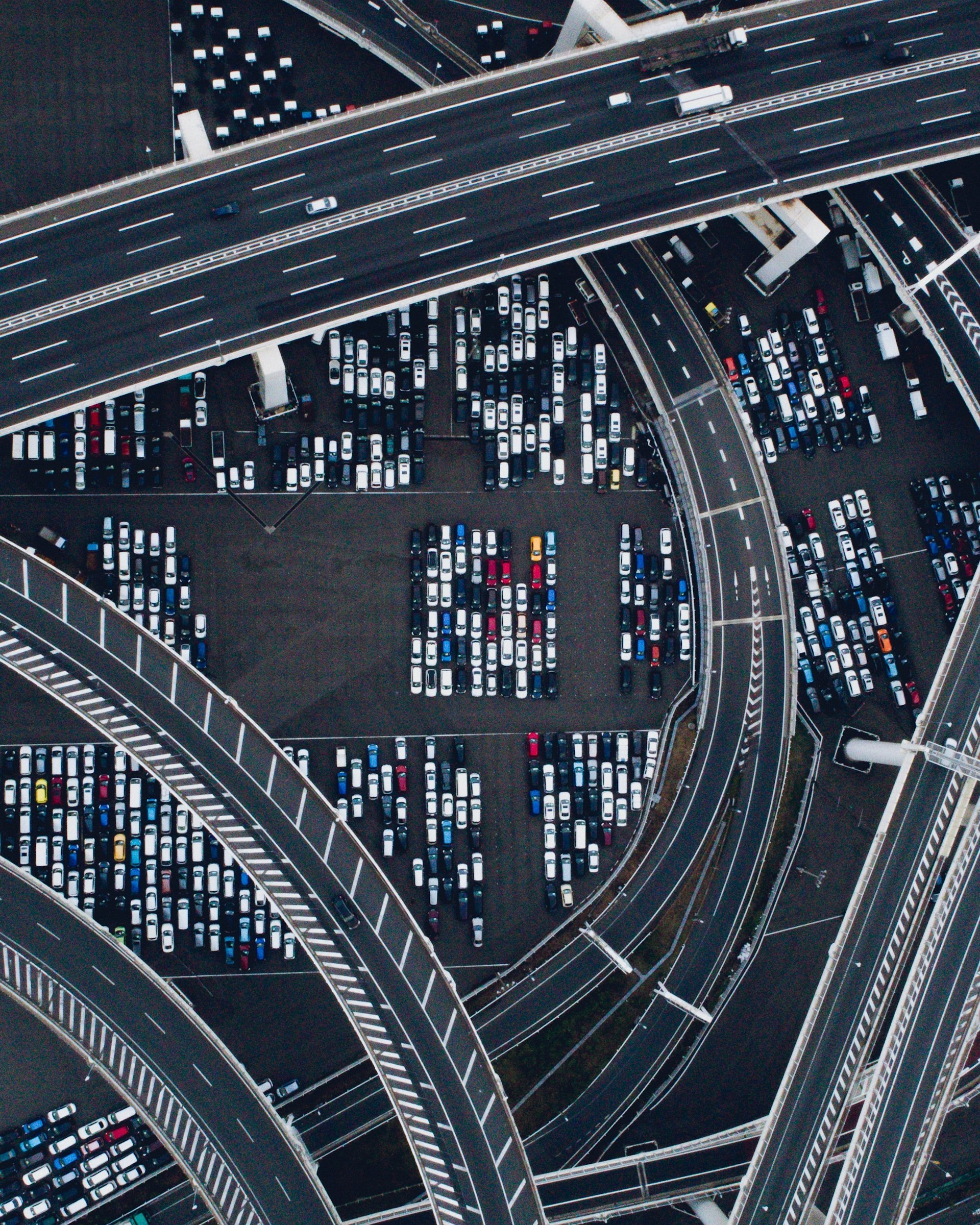

Photo by Jakub Żerdzicki on Unsplash

Introduction: The Rise of AI in Algorithmic Trading

Artificial intelligence (AI) is rapidly reshaping the landscape of algorithmic trading, introducing unprecedented levels of speed, efficiency, and adaptability to the financial markets. By leveraging machine learning, natural language processing, and advanced data analytics, AI is not only accelerating trade execution, but also enhancing precision and risk management. This article provides a comprehensive guide to understanding the impact of AI on algorithmic trading efficiency, detailing core benefits, practical applications, challenges, and step-by-step approaches for firms and traders seeking to maximize the potential of these technologies.

The Core Benefits of AI in Algorithmic Trading

AI has introduced several transformative benefits to algorithmic trading that have redefined what is possible in financial markets:

- Speed and Efficiency : AI-powered systems execute trades at lightning speed, minimizing latency and allowing firms to capitalize on fleeting market opportunities. This efficiency often surpasses human traders, who cannot match the real-time data analysis and rapid execution of AI-driven algorithms [1] .

- Enhanced Precision : By processing vast amounts of structured and unstructured data, AI algorithms can identify subtle market patterns and signals, enabling more accurate and data-driven trading decisions. This leads to higher quality trades and reduced error rates [1] .

- Improved Risk Management : AI excels at detecting risks in real time. Algorithms can monitor positions, assess portfolio exposure, and identify abnormal trading patterns, helping traders mitigate risks proactively [1] .

- Adaptability : Unlike traditional rule-based systems, AI models can learn from new data and adapt to changing market conditions, ensuring continued effectiveness even as market dynamics evolve [1] .

Practical Applications of AI in Algorithmic Trading

AI technologies are being adopted across a range of algorithmic trading applications:

Photo by Arthur A on Unsplash

- Sentiment Analysis : Using natural language processing (NLP), AI examines news, social media, and financial reports to gauge market sentiment. For instance, algorithms can detect shifts in investor mood following a major news event, allowing traders to adjust strategies in real time [1] .

- Pattern Recognition : AI models excel at identifying complex patterns in historical and live market data. This ability helps traders detect emerging trends and exploit new opportunities ahead of the broader market [1] .

- Predictive Analytics : Machine learning algorithms are used to forecast price movements based on real-time and historical data. These predictive tools help traders anticipate market shifts and position portfolios accordingly [2] .

- Fraud Detection and Compliance : AI is increasingly used to monitor trading activity for signs of fraud or market manipulation, and to ensure compliance with regulatory standards. This enhances market integrity and protects stakeholders [2] .

Real-World Impact: Efficiency and Market Dynamics

The impact of AI-driven algorithmic trading is evident in the rapid transformation of global capital markets. According to recent estimates, about 70% of total trading volume in the U.S. stock market is now executed through algorithmic trading, much of it powered by AI [4] . The algorithmic trading market itself is valued at over $15 billion globally and is expected to continue double-digit growth through 2030 [4] .

AI’s unparalleled ability to process millions of data points in real time, far outpacing human capacity, has ushered in a new era of high-frequency trading (HFT). In HFT, AI systems execute thousands of trades per second, exploiting minute price differences and market inefficiencies that are invisible to manual traders [5] .

Step-by-Step Guide: Implementing AI in Algorithmic Trading

For traders and firms interested in adopting AI-driven algorithmic trading, the following steps offer a practical pathway:

- Assess Your Data Infrastructure : Begin by evaluating the quality and availability of your market data. AI models require large, clean datasets for training and real-time analysis. Consider collaborating with established data vendors or building internal data pipelines for structured and unstructured data.

- Define Trading Objectives : Establish specific goals for your AI trading system, such as increasing execution speed, improving risk-adjusted returns, or enhancing compliance monitoring. Clear objectives will guide your technology and model selection.

- Select Appropriate AI Models : Depending on your objectives, choose models best suited to the task. For pattern recognition and predictive analytics, supervised and unsupervised machine learning models are typical. For sentiment analysis, NLP models are essential. Leverage open-source frameworks or partner with technology providers specializing in financial AI.

- Develop and Backtest Algorithms : Build your AI trading strategies and rigorously backtest them using historical data. This process helps identify strengths, weaknesses, and areas for refinement before live deployment.

- Integrate with Execution Systems : Connect AI models to your trading platform to enable real-time trade execution. Ensure robust connectivity and low-latency infrastructure for optimal results.

- Monitor and Adapt : Continuously monitor trading performance and market conditions. Use AI’s adaptive capabilities to retrain models as new data becomes available and as market conditions change.

- Ensure Regulatory Compliance : Stay informed about evolving regulatory requirements for AI and algorithmic trading. AI can help with compliance monitoring, but human oversight remains critical.

- Address Security and Ethical Considerations : Implement safeguards to prevent misuse, market manipulation, and unintended consequences. Develop protocols for handling anomalous behavior and ensure transparency in automated decisions.

Challenges and Limitations of AI-Driven Trading

Despite its many advantages, AI in algorithmic trading is not without limitations. Some of the key challenges include:

- Data Quality and Bias : AI models depend on the quality and representativeness of training data. Poor or biased data can lead to flawed predictions and costly errors. Regular data audits and diverse data sources are essential [4] .

- Market Stability Concerns : While AI can enhance efficiency, its widespread use may introduce new risks, such as flash crashes or market manipulation. There is ongoing debate over how AI-driven strategies might affect long-term market stability [2] .

- Regulatory and Ethical Risks : The ability of AI systems to autonomously learn and adapt can lead to unforeseen behavior, including algorithmic collusion or compliance breaches, even without direct human intervention [3] . Regulatory agencies are actively monitoring these developments and may introduce new guidelines.

- Lack of Human Judgment : While AI excels at pattern recognition and data processing, it lacks the intuitive judgment and experience that seasoned traders bring. Hybrid approaches-where AI supports, but does not fully replace, human oversight-are common.

Alternative Approaches and Additional Resources

Not every trading firm needs to build proprietary AI systems from scratch. Many established technology providers offer AI-powered trading platforms and API access. For those seeking more information or hands-on experience:

- Consider exploring educational content from well-known business schools and financial institutions.

- Engage with open-source AI communities or attend industry conferences focused on technology in trading.

- Monitor official statements and guidance from regulatory agencies such as the U.S. Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC) for updates on compliance and best practices.

If you are interested in learning more or implementing AI in your trading operations, you can:

- Consult with technology vendors who specialize in financial AI solutions.

- Search for ‘AI algorithmic trading platforms’ on reputable financial technology websites and compare available offerings.

- Contact your brokerage or trading platform to inquire about AI-enabled trading tools and services.

For regulatory updates and compliance resources, visit the official websites of the U.S. Securities and Exchange Commission or the Commodity Futures Trading Commission, and use search terms like ‘AI in algorithmic trading’.

Key Takeaways

AI is fundamentally transforming algorithmic trading, offering unmatched speed, precision, and adaptability. The integration of AI in trading strategies empowers traders to extract more value from data, execute trades with greater efficiency, and manage risks more effectively. However, successful implementation requires investment in data infrastructure, ongoing monitoring, and careful attention to regulatory and ethical considerations. By following best practices and staying informed about emerging developments, firms and individual traders can harness the full potential of AI-driven trading systems to achieve superior outcomes in increasingly complex markets.

References

[1] UTrade Algos (2025). What Role Does AI Play in Algorithmic Trading?

[3] NYU Law (2023). AI-Powered Trading, Algorithmic Collusion, and Price Efficiency.

[4] Michigan Journal of Economics (2025). The Use of AI and AI Algorithms in Financial Markets.