How Big Data Is Transforming Financial Forecasting: Strategies, Use Cases, and Steps to Harness Its Power

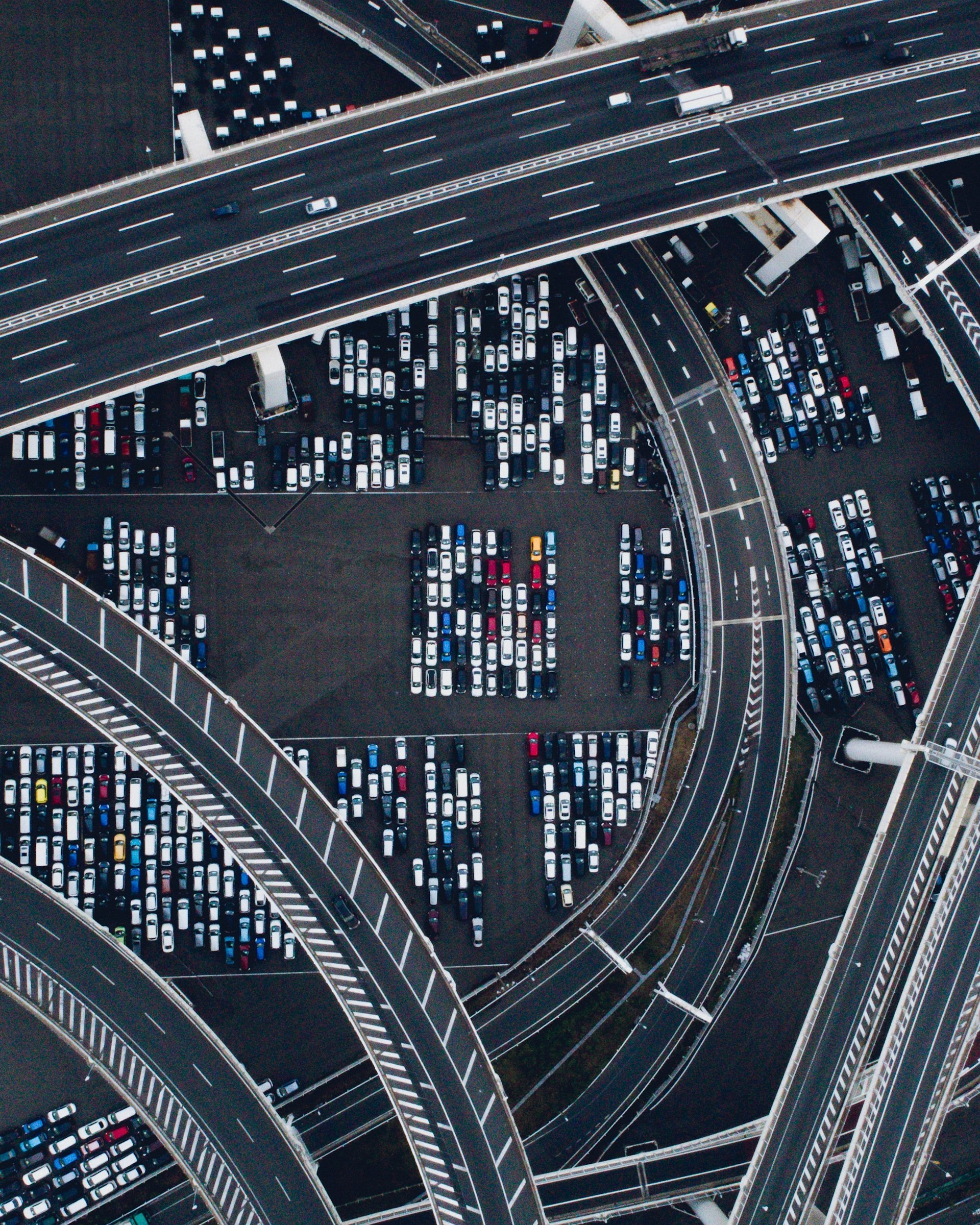

Photo by KOBU Agency on Unsplash

Introduction: The Big Data Revolution in Finance

In recent years, financial forecasting has undergone a seismic shift. The emergence of big data -massive, fast-moving, and diverse data sets-has changed how organizations predict market trends, assess risk, and make investment decisions. This article explores the actionable role of big data in financial forecasting, from its core applications and benefits to step-by-step guidance for implementation, including practical examples and alternative approaches.

Understanding Big Data in Financial Forecasting

Big data refers to the vast volumes of structured and unstructured data generated from sources like transaction records, market feeds, social media, sensors, and customer interactions. In financial forecasting, this data provides a richer, more nuanced foundation for predictive models and real-time decision-making. Traditional forecasting methods-reliant on historical reports and limited data points-are increasingly being replaced by analytics tools that can process terabytes of information for deeper, more accurate insights [2] .

Core Applications and Benefits of Big Data in Financial Forecasting

1. Enhanced Predictive Analysis

Big data enables financial institutions to build predictive models that utilize both historical and real-time data. By analyzing trends, economic indicators, and behavioral data, organizations can forecast future movements in stock prices, interest rates, and credit risks with greater precision [3] . For instance, banks now use customer transaction histories and market sentiment data to assess the likelihood of loan defaults or to time investment decisions more effectively.

Example: A global investment firm implemented big data analytics to analyze millions of transactions and social media trends, enabling them to anticipate market swings and adjust portfolios rapidly-outperforming competitors using traditional models.

Implementation Steps:

- Aggregate diverse data sources, including internal transaction data and external feeds (news, social media).

- Clean and normalize the data to ensure consistency.

- Apply machine learning models that can process and learn from these large datasets.

- Continuously retrain models with new data for improved accuracy.

Potential Challenges: Data quality and integration can be obstacles, requiring robust data management systems. Consider consulting with data engineering specialists to streamline this process.

2. Real-Time Risk Management

Managing financial risk is more complex than ever. Big data analytics allows institutions to assess risk exposure across portfolios in real time, improving their ability to respond to volatile markets and potential losses. Modern systems analyze thousands of data points-such as earnings reports, broker analyses, and geopolitical events-to provide up-to-the-minute risk assessments [5] . This capability enables proactive risk mitigation and supports compliance with regulatory requirements.

Real-World Case: BlackRock, a leading asset management firm, processes over 6,000 broker reports and 5,000 earnings call transcripts daily with AI tools to assess risk exposure and inform investment strategies [5] .

Photo by Adam Åšmigielski on Unsplash

How to Get Started:

- Identify key risk indicators for your organization-such as credit defaults, market volatility, or operational threats.

- Deploy analytics platforms capable of ingesting and analyzing both structured and unstructured data.

- Integrate outputs with dashboards accessible to risk managers in real time.

- Regularly review model performance and recalibrate based on evolving risk profiles.

3. Improved Credit Risk Assessment and Dynamic Scoring

Traditional credit scoring methods rely on limited data and periodic updates. Big data analytics provides a more holistic, dynamic view by incorporating alternative data-such as utility payments, social media activity, and real-time financial behavior [1] . Predictive risk models built on big data can forecast the likelihood of default or delinquency, enabling lenders to make more informed decisions and offer fairer credit terms to a broader population.

Steps to Implement:

- Expand your data collection to include non-traditional sources (with compliance to privacy regulations).

- Use advanced analytics platforms to process and correlate diverse datasets.

- Develop dynamic scoring models that update continuously as new data arrives.

Alternative Approaches: For organizations with limited data infrastructure, consider partnering with fintech firms that offer credit analytics as a service, or utilize cloud-based analytics solutions.

4. Personalization and Customer Insights

Financial institutions use big data to analyze customer preferences, behaviors, and needs, allowing them to tailor products and communications. By mining transaction histories, CRM data, and social interactions, banks and investment firms can recommend products that align with individual risk appetites and financial goals [4] . This not only enhances customer satisfaction but also increases cross-selling opportunities and loyalty.

How to Leverage:

- Deploy customer analytics tools to segment your audience by behavior, demographics, and needs.

- Automate personalized offers and communications using insights from data models.

- Monitor engagement metrics and adjust targeting strategies in response to real-time feedback.

Implementing Big Data in Financial Forecasting: Step-by-Step Guidance

Integrating big data into your financial forecasting requires a systematic approach. Here is a roadmap for organizations seeking to unlock the full potential of data-driven finance:

- Assess Organizational Readiness: Evaluate your current data infrastructure, talent, and analytics tools. Identify gaps in data collection, storage, and analysis.

- Define Forecasting Objectives: Clarify which areas (risk management, credit scoring, investment prediction) will benefit most from big data analytics.

- Source and Integrate Data: Collect data from internal (transaction logs, CRM) and external (market feeds, social media) sources. Ensure data privacy and compliance at all stages.

- Select Analytics Tools: Choose platforms capable of handling large-scale data analysis-these may include cloud-based solutions, AI-driven modeling tools, or specialized fintech services.

- Develop and Validate Models: Collaborate with data scientists to build predictive models tailored to your objectives. Validate accuracy through back-testing against historical results.

- Embed Analytics into Decision-Making: Integrate insights into daily workflows via dashboards, alerts, and automated reporting for finance teams and executives.

- Monitor, Iterate, and Scale: Continuously track performance, incorporate new data sources, and refine models to adapt to changing market conditions.

Organizations without in-house analytics expertise can seek partnerships with technology providers or outsource initial model development to reputable consulting firms. Consider searching for “financial analytics consulting” or “big data finance solutions” to explore available service providers.

Potential Challenges and Solutions

Adopting big data in financial forecasting is not without hurdles. Common challenges include data silos, integration difficulties, privacy concerns, and a shortage of skilled personnel. To overcome these, organizations should:

- Invest in centralized data platforms and adopt industry-standard data governance practices.

- Prioritize ongoing staff training in data analytics and compliance.

- Engage third-party experts for system implementation and model validation if internal resources are limited.

- Stay informed about changing regulations by following updates from financial regulators and data protection authorities.

It is important to note that while big data can enhance forecasting accuracy, results will depend on the quality of data, robustness of models, and the agility of the organization in responding to insights.

Alternative and Emerging Approaches

Beyond traditional big data analytics, financial institutions are exploring advanced AI and machine learning techniques, such as deep learning and digital twins, to simulate complex scenarios and stress-test financial models [5] . Cloud-based analytics solutions offer scalable, cost-effective options for organizations lacking extensive IT infrastructure. Open-source tools and platforms also make advanced analytics accessible to smaller firms. To explore available resources, consider searching for “cloud-based financial analytics tools” or visiting the websites of established technology providers.

Practical Guidance for Accessing Big Data Financial Forecasting Solutions

If you are interested in leveraging big data for financial forecasting, you can:

- Consult with major analytics providers or established fintech firms that specialize in financial modeling and data integration. Search for “financial analytics consulting” for reputable firms.

- Engage with your industry association or regulatory body for guidance on compliance and best practices.

- Participate in industry conferences, webinars, or online courses focused on big data in finance to build internal expertise.

- Review case studies and vendor offerings published on established financial technology and industry news websites.

For organizations at an early stage, starting with a pilot project focused on a single forecasting challenge-such as credit risk assessment or market prediction-can provide valuable learning and demonstrate value before scaling up.

Conclusion: The Future of Financial Forecasting Is Data-Driven

Big data is rapidly transforming financial forecasting, empowering institutions to deliver more accurate predictions, manage risk proactively, and respond to market dynamics in real time. By following the steps and best practices outlined above, organizations can harness the power of data-driven insights for sustainable growth and competitive advantage. As the financial landscape continues to evolve, the ability to leverage big data effectively will distinguish industry leaders from the rest.

References

- [1] Finage (2024). Leveraging Big Data for Enhanced Financial Forecasting.

- [2] InData Labs (2023). Big Data Analytics & Forecasting Guide.

- [3] Turing (2024). Big Data in Finance: Benefits, Use Cases, and Examples.

- [4] Tratta.io (2023). Big Data Applications and Benefits in Finance.

- [5] Coherent Solutions (2025). AI in Financial Modeling and Forecasting: 2025 Guide.