How Climate Risk Disclosure Is Transforming Corporate Finance

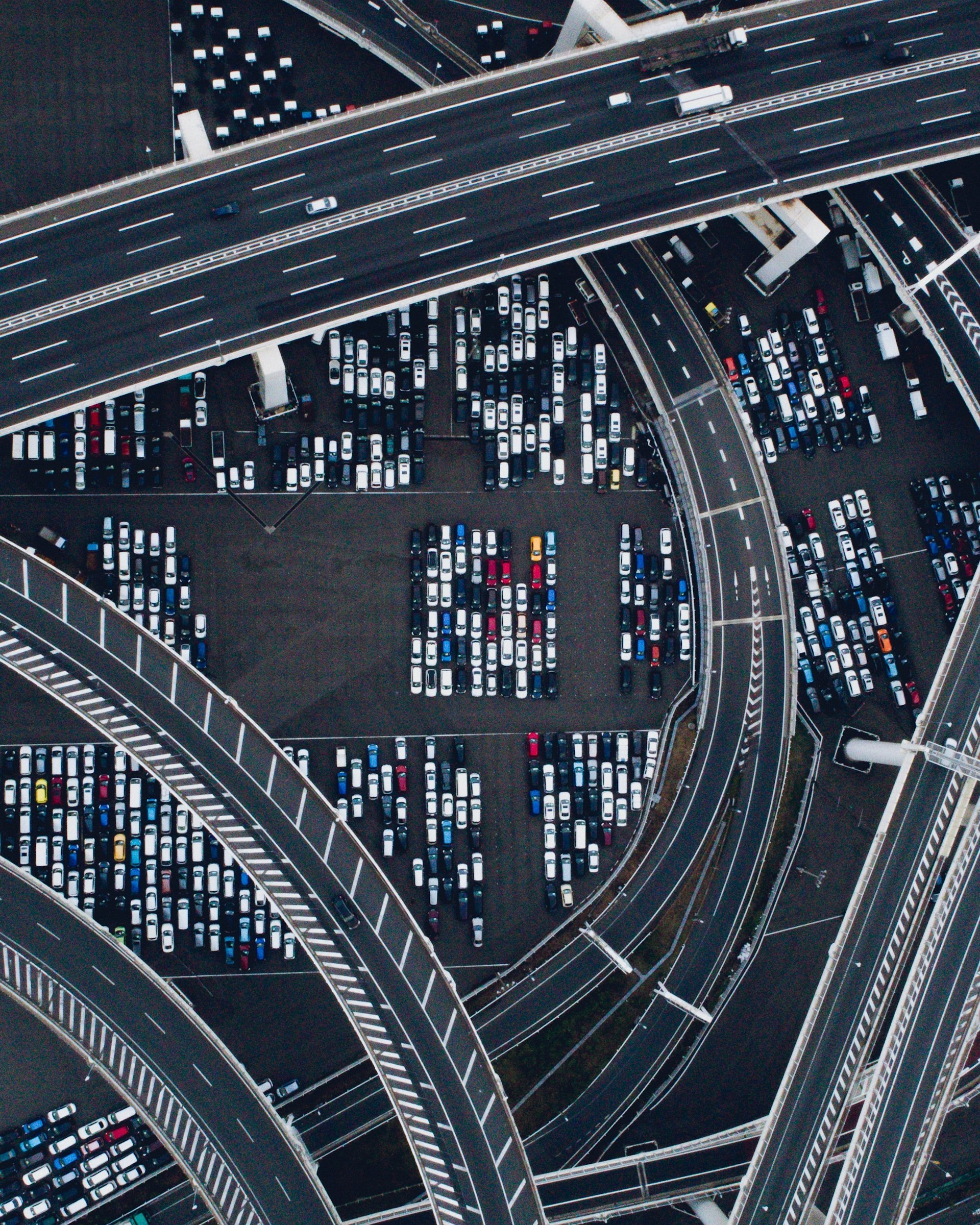

Photo by Louis Droege on Unsplash

Understanding the Financial Impact of Climate Risk Disclosure

As climate change accelerates, its effects-ranging from extreme weather to regulatory changes-pose significant financial and operational risks for businesses. To address these challenges, governments and regulatory bodies are increasingly mandating climate risk disclosure in corporate financial reporting. This shift is not only about compliance, but also about enabling investors, lenders, and executives to make more informed financial decisions based on a company’s exposure to climate-related risks and its mitigation strategies. [1] [2]

Why Climate Risk Disclosure Matters for Corporate Finance

Transparent climate risk reporting directly influences a company’s financial standing in several ways:

- Investor Confidence: Standardized disclosures help investors compare climate-related risks across companies and industries, reducing uncertainty and supporting more confident capital allocation. [1]

- Cost of Capital: Companies with robust climate risk management may benefit from lower borrowing costs and increased access to financing, as investors and creditors increasingly factor climate resilience into their decisions. [2]

- Risk Management: Proactive disclosure encourages organizations to assess and manage both physical (e.g., extreme weather, resource scarcity) and transition (e.g., regulatory, reputational) risks, reducing the likelihood of unexpected losses. [4]

For example, in 2024, the U.S. experienced 27 weather-related disasters exceeding $1 billion each in damages, more than doubling the average from the prior decade. Companies exposed to such risks face operational disruptions, asset damage, and increased insurance costs. [4]

The Evolving Regulatory Landscape

Recent regulations are driving a new era of corporate transparency. The U.S. Securities and Exchange Commission (SEC) introduced a climate disclosure rule in 2024, requiring publicly traded companies to include detailed climate-related risks in annual reports and registration statements. Key requirements include:

- Governance and Risk Management: Companies must explain how their boards oversee climate-related risks and integrate them into strategic planning.

- GHG Emissions Reporting: Disclosure of direct (Scope 1) and indirect (Scope 2) greenhouse gas emissions is required for large filers, with additional requirements if supply chain (Scope 3) risks are deemed financially significant. [1]

- Financial Statement Impacts: Companies must report the financial effects of climate-related costs, such as carbon offset purchases, renewable energy credits, and losses from extreme weather.

Globally, the trend is similar, with the EU Corporate Sustainability Reporting Directive (CSRD) and other standards aligning requirements and making reporting more consistent across jurisdictions. [2]

How to Prepare for Climate Risk Disclosure Requirements

For companies new to these requirements, early preparation is vital. Here’s a step-by-step approach:

- Assess Exposure: Identify physical and transition climate risks relevant to your operations, assets, supply chain, and markets.

- Establish Governance: Assign board and executive oversight for climate risk management. Consider forming a dedicated sustainability committee or task force.

- Align with Frameworks: Use established reporting frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) to structure your disclosures around governance, strategy, risk management, and metrics. [4]

- Collect Data: Gather reliable data on greenhouse gas emissions, climate-related costs, and relevant operational metrics. This may require new data systems or third-party verification.

- Integrate into Reporting: Ensure climate risk disclosures are included in annual reports, 10-K filings, and investor communications as required by regulators. [3]

- Engage Stakeholders: Communicate proactively with investors, lenders, and rating agencies about your climate risk strategy, targets, and progress.

If you are unsure where to begin, you can consult with sustainability consultants, audit firms, or legal advisors specializing in ESG and climate risk. Consider searching for “climate risk disclosure consulting” or visit the official U.S. Securities and Exchange Commission (SEC) website for guidance documents and reporting templates.

Sector-Specific Impacts and Examples

Different industries face unique climate-related financial risks and disclosure challenges:

Photo by Dillon Kydd on Unsplash

- Utilities and Energy: Must report on grid vulnerability, decarbonization mandates, and stranded assets. For example, power companies may be required to disclose how shifting to renewables affects their asset values and long-term strategy. [4]

- Real Estate: Exposed to asset devaluation and rising insurance costs due to flood and wildfire risks. Disclosure helps investors assess the long-term value and risk of real estate portfolios.

- Consumer Staples and Agriculture: Face supply chain disruptions from water scarcity and crop volatility. Companies are expected to report on how these risks affect their sourcing and pricing strategies.

According to a recent analysis, 84% of S&P 500 companies and 42% of Russell 3000 companies now align their disclosures with TCFD recommendations, up significantly from just a few years ago. [4]

The Role of Peer Influence and Best Practices

Research indicates that companies often look to their peers for guidance on the depth and specificity of climate risk disclosures. This “herding” effect is especially pronounced in high-risk industries and among firms with substantial institutional ownership or analyst scrutiny. By benchmarking against industry leaders, companies can gauge stakeholder expectations and mitigate reputational risks. [5]

For practical implementation:

- Review leading disclosures within your sector to understand best practices.

- Adapt disclosure templates and language from larger or more experienced peers, while tailoring to your company’s specific risks and strategies.

- Regularly update disclosures as new information and standards emerge.

Overcoming Common Challenges

Implementing robust climate risk disclosure can present several hurdles:

- Data Collection: Gathering accurate emissions and risk data-especially from complex supply chains-can be resource-intensive. Consider phased approaches or third-party audits to improve reliability over time.

- Materiality Judgments: Determining which risks are financially “material” for disclosure may require legal or expert input. If uncertain, err on the side of transparency or consult regulatory guidance.

- Regulatory Uncertainty: Disclosure requirements are evolving. Stay updated through official sources such as the SEC and industry associations, and remain flexible to adjust to new rules.

Where you need more guidance, consider contacting your industry’s main trade association or searching regulatory agency pages (such as the SEC) for the latest updates.

Key Takeaways and Next Steps

Climate risk disclosure is now a core component of corporate finance and investor relations. Companies that proactively assess and report on climate risks are better equipped to attract investment, manage regulatory compliance, and protect long-term value. As mandates become more widespread and stringent, early preparation and alignment with best practices are critical for maintaining financial resilience.

To get started, you can:

- Assign climate risk disclosure responsibilities to your board or executive team.

- Benchmark your disclosures against industry leaders using public filings and sustainability reports.

- Engage external consultants or legal advisors for expertise.

- Visit the official SEC website or search for “SEC climate disclosure guidance” for compliance resources and updates.

- Connect with your investors and stakeholders to understand their expectations regarding climate risk transparency.

References

- [1] EcoVadis (2024). SEC Climate Risk Disclosure: What You Need to Know.

- [2] World Resources Institute (2024). Corporate Climate Disclosure Has Passed a Tipping Point.

- [3] Harvard Law School Environmental & Energy Law Program (2024). Financial Regulation, Climate Change, and Climate-related Risk Disclosure Tracker.

- [4] Harvard Law School Forum on Corporate Governance (2025). Corporate Climate Disclosures and Practices: Risk, Emissions, and Targets.

- [5] SSRN (2024). Herding in Corporate Climate Risk Disclosure.