Mastering Financial Planning for a Smooth International Relocation

Photo by Denise Jans on Unsplash

Introduction

Relocating internationally is an exciting venture, but it comes with complex financial challenges that require careful planning. Whether moving for work, family, or adventure, having a robust financial plan ensures you start your new life on stable footing. This guide explores every element of financial planning for international relocation, offering actionable steps, verified resources, and real-world examples to help you navigate this journey with confidence.

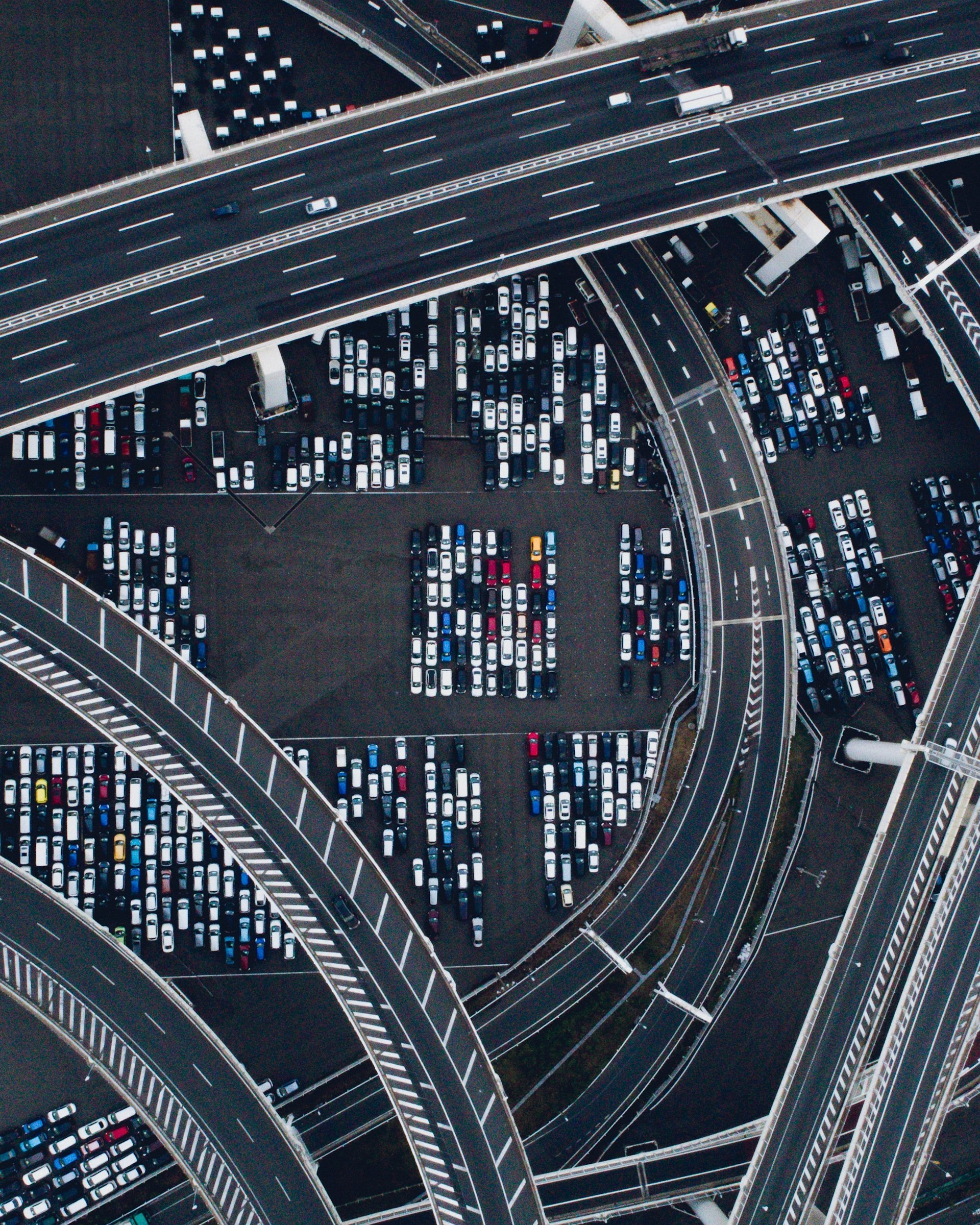

Photo by wilsan u on Unsplash

Understanding Financial Implications of Moving Abroad

Moving to a new country involves more than travel expenses; it requires a complete assessment of your financial landscape. Key costs include visa applications, travel, accommodation, healthcare, insurance, and legal fees. Anticipating these expenses prevents unpleasant surprises and allows for effective budgeting. For instance, many families underestimate the cost of international shipping and temporary housing, leading to budget overruns. According to relocation experts, creating a detailed list of all anticipated costs-including packing, moving company charges, insurance, and emergency reserves-is the foundation of a sound financial plan [1] .

Creating a Comprehensive Financial Plan

Begin by setting up a budget that covers pre-move, transition, and post-arrival costs. This should include:

- Visa and legal documentation fees

- Travel expenses (flights, ground transportation)

- Cost of living in the new country (housing, utilities, groceries)

- Healthcare and insurance

- Emergency fund for unforeseen events

- Asset restructuring costs

Use recent exchange rates and transfer fees to estimate costs accurately. Many people benefit from using online calculators or consulting with financial advisors experienced in cross-border moves [2] . For example, a family moving to Germany may find local health insurance mandatory and considerably more expensive than in their home country, so factoring this into the budget is essential.

Managing Currency Exchange and International Banking

Understanding exchange rates and transfer fees is vital. Currency fluctuations can dramatically impact your budget, especially if you need to convert large sums for initial living expenses. Research the best ways to transfer money, such as using services like Wise or Revolut, which often offer lower fees than traditional banks. However, keep in mind that funds transferred via non-bank apps may not be FDIC insured, so use them for smaller amounts and rely on conventional banks for larger transfers [5] .

Setting up a local bank account is often required for daily transactions. Some countries allow you to open an account with just a passport, while others require proof of residency or a visa. Start this process early to avoid delays and ensure access to funds upon arrival. If opening a bank account is not possible before your move, prepare to use your home country account-while being aware of potential foreign transaction fees.

Asset Restructuring and Tax Considerations

International relocation often necessitates reviewing and restructuring your assets, especially for tax efficiency. Some countries tax spouses individually, while others tax jointly, which can affect how assets are divided and reported. Distributions from retirement accounts, such as Roth IRAs, may be taxed differently abroad, so consider the timing of withdrawals. For example, Americans moving to the EU may find that government pensions are taxed differently depending on their new country’s laws. Consulting with a cross-border tax advisor before your move is highly recommended [4] . To find qualified advisors, search for “international tax consultant” or contact reputable firms specializing in expat financial planning.

Insurance and Healthcare Planning

Securing insurance coverage is a top priority. Many countries require proof of health insurance for visa approval. Research local insurance providers and compare coverage options. For Americans, international health insurance policies can be purchased from established companies with verified online presence. Begin by searching for “international health insurance” and reviewing plans from major insurers. Additionally, consider travel insurance for the relocation period itself.

Some countries offer national health insurance, while others require private coverage. Factor these costs into your budget and ensure you have adequate protection for both emergencies and routine care. If you have existing health conditions, confirm coverage details before departure.

Managing Investments and Retirement Accounts

Moving abroad doesn’t necessarily mean transferring your investments. Many experts advise keeping U.S.-based investments to avoid complications with foreign account reporting and double taxation. However, you may need to notify your investment provider about your change in residency. For retirement accounts, review how distributions will be taxed in your new country and consider timing withdrawals before your move if advantageous [4] .

For up-to-date guidance, search for “expat investment management” or “international financial advisor” and contact firms with proven experience in cross-border asset management.

Step-by-Step Implementation Guidance

Here is a step-by-step approach to financial planning for international relocation:

- Assess your financial situation. List assets, debts, income sources, and monthly expenses.

- Research the cost of living in your destination country using reputable sources, such as official government websites or expat communities.

- Create a relocation budget. Include all anticipated expenses, emergency reserves, and asset restructuring costs.

- Consult with financial and tax advisors specializing in international moves for tailored guidance.

- Open a local bank account in your destination country, if possible, before your arrival. If not, prepare alternative banking arrangements.

- Secure international health insurance and any required local coverage.

- Review and adjust your investments and retirement accounts to minimize tax liabilities and reporting requirements.

Each step may present unique challenges, such as delays in account opening or unexpected tax issues. Always have backup plans and consult multiple sources for advice.

Alternatives and Additional Resources

If direct access to financial services is limited, consider these alternatives:

- Use online platforms like Wise and Revolut for smaller money transfers, but keep large sums in established banks for security [5] .

- Join expat forums and communities for firsthand advice and local recommendations.

- Contact embassies or consulates for information on local regulations and services.

- Search for “international moving company” to compare services and get quotes from verified providers.

Always verify the legitimacy of any financial or moving service before committing funds.

Key Takeaways

Financial planning for international relocation requires a multi-faceted approach, covering budgeting, currency exchange, asset restructuring, banking, insurance, and investments. By following the steps outlined above and consulting authoritative sources, you can ensure a smooth and secure financial transition to your new home.

References

- [1] Moovick (2023). How to Financially Prepare for Your International Move.

- [2] The Relocator (2023). How to Budget for an International Move: A Step-By-Step Guide.

- [3] HSBC Expat (2023). Guide To Moving Abroad – Moving Overseas.

- [4] Creative Planning (2023). Financial Considerations for a Move Abroad.

- [5] Worth (2023). Financial Considerations for Americans Moving Abroad: A Guide.