Mastering Financial Planning for Travel Lovers: Sustainable Strategies for Exploring the World

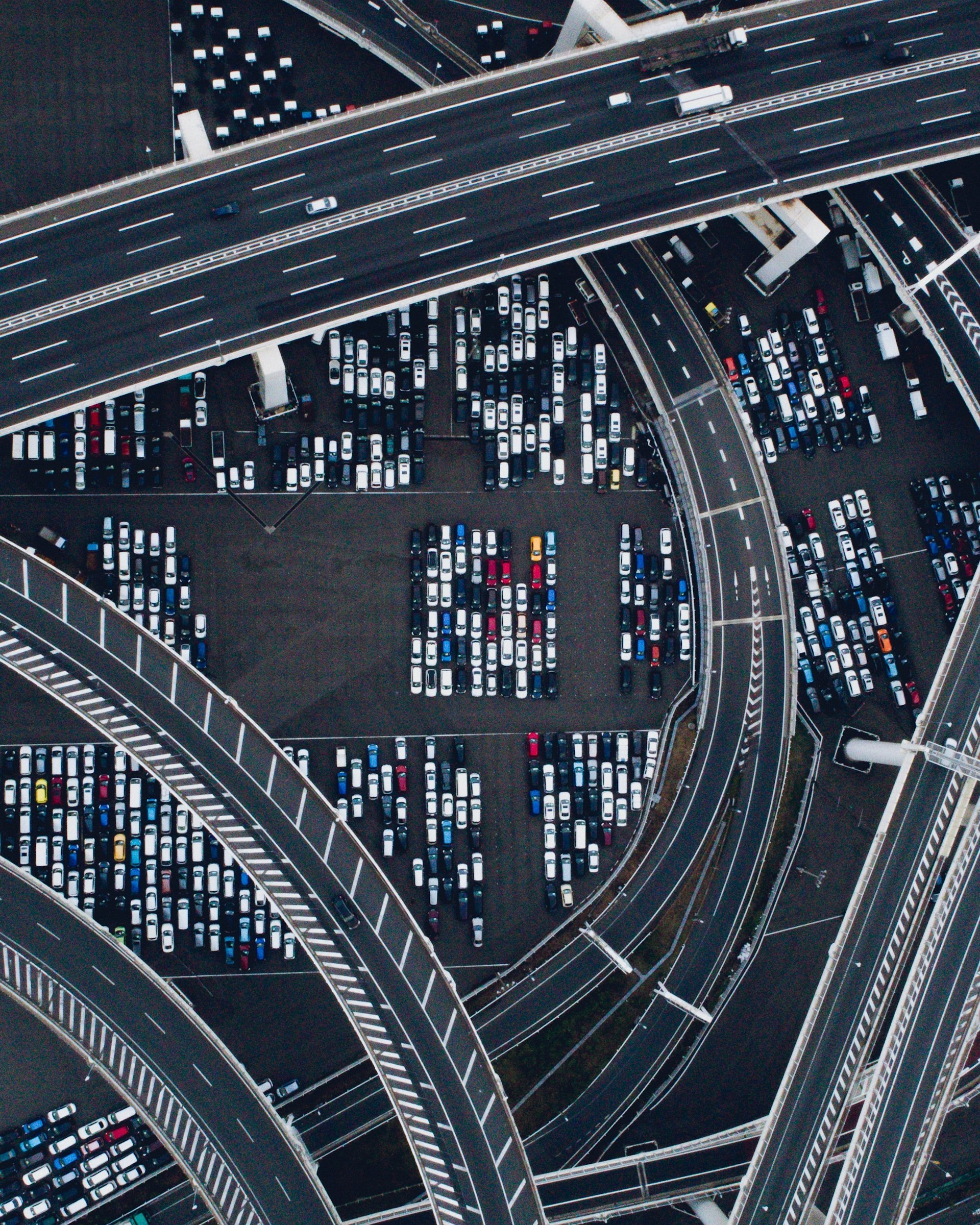

Photo by Odinei Ramone on Unsplash

Introduction: Why Financial Planning Is Essential for Travel Enthusiasts

For those who dream of exploring new destinations, effective financial planning is the key to transforming travel ambitions into reality. Whether you aspire to take annual vacations or embark on extended journeys as a digital nomad, thoughtful preparation allows you to maximize your experiences while minimizing financial stress. This guide provides actionable steps, real-world examples, and reliable resources to help you travel further and more often-without jeopardizing your financial security.

1. Clarify Your Travel Goals and Make Them a Priority

Start by defining the types of trips you want to take over the next year or longer. Are you planning a family vacation, a solo backpacking trip, or a multi-country adventure? Discuss your goals with travel partners to set expectations and priorities. According to financial advisors, making travel a clear priority increases your likelihood of following through on your plans and building a realistic budget [2] .

Practical steps include:

- List your desired destinations and experiences for the upcoming year.

- Research best times to travel and potential costs for each trip.

- Decide who will be joining you and how costs will be shared.

Example: A couple planning a European vacation begins by outlining their preferred countries, researching festivals and off-peak seasons, and estimating costs based on length of stay and type of accommodation.

2. Calculate and Track Travel Costs

Creating a realistic travel budget involves careful research and categorization of expenses. Common categories include transportation, lodging, food, activities, insurance, and miscellaneous costs. Use budgeting apps or spreadsheets to compare estimates against actual spending during your trip [1] , [3] .

Step-by-step guidance:

- Research transportation options (flights, trains, buses) and compare prices using established fare comparison sites such as Skyscanner or Kayak. Always verify the latest rates and look for deals [3] .

- Investigate accommodation choices, from hostels to vacation rentals. Consider facilities that include meals or shared kitchens to save money.

- Create separate budget lines for fixed (e.g., flights, hotel bookings) and variable expenses (e.g., meals, entertainment).

- Regularly track your expenses using financial apps or by manually recording daily spending.

Example: A solo traveler estimates $1,000 for flights, $700 for lodging, $400 for food, and $300 for activities for a two-week Southeast Asia trip. They use a free budgeting tool linked to their bank account to monitor spending on-the-go.

3. Build a Dedicated Travel Fund

One of the most effective ways to ensure you have the money you need is to establish a separate travel savings account . Financial planners recommend using an account with a competitive interest rate and limited ATM access to minimize the temptation to spend prematurely [1] .

How to set it up:

- Open a new high-yield savings account (many online banks offer attractive rates; search for “best high-yield savings accounts” on credible financial review sites).

- Set up automatic transfers from your main account to your travel fund each payday.

- Increase your monthly contribution during months when you receive bonuses or reduce discretionary expenses elsewhere.

Example: A traveler sets a goal to save $3,000 over 12 months, automating $250 transfers to their travel account. They supplement their savings by redirecting money saved from reduced dining out and subscription services.

4. Optimize Rewards and Cut Costs

Maximizing rewards programs and cutting unnecessary expenses can significantly accelerate your travel savings. Many seasoned travelers use credit cards that offer travel-related perks, such as points, miles, or cash back. However, it is crucial to pay your balance in full each month to avoid interest charges [4] .

Practical implementation:

- Compare travel credit cards from established banks and review their benefits and fees on reputable financial websites.

- Use your selected card for everyday purchases to accumulate points, but never spend beyond your means.

- Combine rewards from multiple sources (airlines, hotels, shopping portals) to maximize redemption value.

- Continuously look for new ways to cut fixed and variable expenses at home, redirecting those savings toward your travel fund [5] .

Example: A digital nomad uses a travel rewards card for groceries and utilities, earning enough points for a free domestic flight each year. They also switch to a lower-cost cell phone plan and cancel unused subscriptions, adding the difference to their travel savings.

5. Prepare for Unexpected Expenses and Emergencies

No travel plan is complete without preparing for the unexpected. Set aside an emergency fund separate from your travel savings to cover unforeseen costs, such as medical emergencies, flight cancellations, or lost luggage. Travel insurance is also highly recommended, especially for international trips.

Photo by Frugal Flyer on Unsplash

How to proceed:

- Research travel insurance providers on established review sites or consult with your primary insurer about add-on coverage.

- Set a goal to maintain at least three to six months of essential expenses in an emergency fund before major trips.

- Keep digital and paper copies of all important documents, including insurance policies, passports, and emergency contacts.

Example: A family traveling overseas purchases a comprehensive travel insurance policy after comparing options on a major insurance marketplace. They also budget a contingency fund of $500 for incidental costs.

6. Seek Professional Guidance for Complex Situations

If you plan to travel extensively, live abroad, or work internationally, consult with a qualified financial advisor. These professionals can help you navigate tax regulations, manage cross-border finances, and optimize long-term financial strategies [2] .

How to find help:

- Search for certified financial planners with experience in international travel or expat finances on the CFP Board or similar professional organizations.

- Request references or case studies relevant to your travel plans before engaging an advisor.

- Prepare questions in advance about tax implications, banking abroad, and currency management.

Example: A retiree planning to spend a year in Europe consults a cross-border tax specialist to understand residency rules, social security implications, and the best ways to access funds while overseas.

7. Alternative and Creative Ways to Fund Your Travel

Beyond traditional savings, travelers are increasingly turning to side hustles, remote work, and volunteering to support their adventures. Opportunities include freelance gigs, seasonal work, or exchanging work for accommodation.

Implementation guidance:

- Explore reputable remote job boards, such as FlexJobs or Remote.co, for work-from-anywhere opportunities.

- Consider platforms like Workaway or WWOOF for volunteer-based travel exchanges (always verify the legitimacy of platforms and read reviews).

- Leverage skills such as photography, writing, or teaching to earn extra income before or during your travels.

Example: An English teacher secures online tutoring work through a leading education platform, enabling them to travel throughout Asia while maintaining a steady income stream.

Key Takeaways and Next Steps

Financial planning for travel enthusiasts is about much more than simply saving money. It requires setting clear goals, building a dedicated savings system, optimizing rewards, and preparing for both expected and unexpected costs. By following these strategies and seeking professional guidance when needed, you can achieve sustainable travel without compromising your financial health. For more in-depth information, consult certified financial planners and use trusted financial resources to tailor a plan that fits your unique aspirations.

References

- [1] Quicken (2022). Financial Planning Tips All Travelers Should Consider.

- [2] JJ Burns (2023). 3 Essential Financial Planning Tips for Travelers.

- [3] BudgetBakers (2023). How To Create A Realistic Travel Budget That Actually Works.

- [4] Burnouts & Budgets (2023). The Best Financial Planning Books for World Travelers.

- [5] Practical Wanderlust (2024). How to Save Money for Travel (& How We Did It).