Navigating Emerging Risks in Algorithmic Trading Systems: Actionable Strategies for 2025

Photo by Markus Winkler on Unsplash

Introduction: The Rapid Evolution and New Risks in Algorithmic Trading

Algorithmic trading systems have transformed financial markets, delivering lightning-fast execution and improved liquidity. However, as these systems grow more sophisticated, a new set of emerging risks is reshaping the landscape for institutional traders, fintechs, and market participants. Successful navigation of these risks requires up-to-date knowledge, robust governance, and proactive risk management. This comprehensive guide explores the most pressing emerging risks in algorithmic trading systems for 2025 and beyond, offering actionable strategies and verifiable insights to help you respond effectively.

1. Cybersecurity Threats: Protecting Your Algorithmic Infrastructure

Financial markets are increasingly interconnected, making algorithmic trading systems attractive targets for cybercriminals. High-profile breaches, such as the 2023 ION Cleared Derivatives incident that disrupted global settlement operations, highlight how a single vulnerability can trigger widespread market dislocation. In February 2025, the Bybit exchange lost nearly $1.5 billion to a hack targeting its critical infrastructure-a stark reminder that third-party dependencies introduce additional vectors for attack [2] .

To safeguard sensitive trading data and maintain operational continuity, firms should:

- Conduct regular cybersecurity audits and penetration testing.

- Vet third-party technology providers rigorously.

- Develop incident response plans to quickly contain breaches.

Many organizations also participate in industry-wide threat intelligence sharing. For guidance, financial institutions may consult the Financial Industry Regulatory Authority (FINRA) for best practices in cyber risk management.

2. Market Volatility and Instability: Managing Automated Reactions

Algorithmic strategies, particularly those based on high-frequency trading (HFT), can react to market signals within milliseconds. While this speed provides an edge, it can also amplify volatility during periods of stress. The infamous Knight Capital incident in 2012, where a faulty algorithm caused $460 million in losses in less than an hour, demonstrates the dangers of relinquishing too much control to automation without sufficient safeguards [2] . Large-scale sell-offs by interconnected algorithms can overload market infrastructure and trigger flash crashes [4] .

To mitigate these risks, firms should:

- Implement circuit breakers and kill switches to halt trading in times of extreme volatility.

- Enforce human-in-the-loop oversight for critical decisions.

- Regularly stress-test algorithms against a range of market scenarios.

Regulatory agencies such as the U.S. Securities and Exchange Commission (SEC) provide guidance on market stability requirements. Firms may also consider joining industry working groups focused on best practices for algorithmic risk controls.

3. Technology Failures and Data Quality: The Hidden Dangers

Algorithmic trading relies on real-time data and robust computing infrastructure. System failures, software glitches, or poor-quality data can lead to erroneous orders and significant financial losses. Even short outages may result in missed opportunities or market disruptions [1] .

Action steps for traders and firms include:

- Ensuring redundant systems and backup data feeds are in place.

- Implementing stringent validation checks for incoming data.

- Establishing real-time monitoring and alerting for system health.

To access practical resources, firms can consult their trading platform provider for documentation on data integrity and failover protocols. Additionally, regular disaster recovery drills can prepare teams for unexpected technology failures.

4. Overfitting, Machine Learning Bias, and Adaptability

The rise of machine learning (ML) in algorithmic trading brings new risks, notably overfitting -where algorithms are excessively optimized for historical data but perform poorly in future, unseen conditions [1] . ML models may also inadvertently encode biases or fail to adapt to structural market changes [3] .

To address these challenges, organizations should:

- Regularly retrain models with diverse, up-to-date datasets.

- Use cross-validation and out-of-sample testing to detect overfitting.

- Maintain clear documentation of model assumptions and limitations.

Firms can consult academic resources or industry groups such as the CFA Institute for guidance on robust ML model development and validation. Staying current with the latest research is essential to avoid pitfalls and maintain a competitive edge.

5. Regulatory and Compliance Risks: Adapting to a Changing Landscape

Regulatory scrutiny of algorithmic and AI-driven trading is intensifying. Authorities are imposing stricter rules on transparency, reporting, and conduct, especially in less-regulated asset classes. The FICC Markets Standards Board (FMSB) has published good practice statements on risk governance and compliance for algorithmic trading participants [5] .

To stay compliant and avoid penalties, firms should:

- Appoint dedicated compliance officers with expertise in algorithmic trading.

- Review and update internal controls to align with evolving regulations.

- Participate in industry consultations and monitor regulatory publications for updates.

You can access regulatory updates by subscribing to mailing lists from official agencies such as the Commodity Futures Trading Commission (CFTC) and the SEC. When in doubt, consult legal counsel specializing in financial regulation and algorithmic trading compliance.

6. Governance, Conduct Risk, and Transparency

Robust governance frameworks are essential to manage the conduct risks associated with algorithmic trading. Without proper oversight, algorithms may inadvertently harm clients, destabilize markets, or engage in manipulative behavior. The FMSB recommends establishing clear lines of responsibility, regular audits, and transparent reporting processes to foster ethical conduct and market integrity [5] .

Practical steps for organizations include:

- Documenting algorithm design, testing, and deployment processes.

- Establishing escalation procedures for anomalies or suspected misconduct.

- Ensuring all staff receive training on ethical and legal standards in algorithmic trading.

To implement these measures, consider referencing publications from the FMSB and industry guidance from global financial institutions. Regular internal reviews can further reinforce a culture of accountability and transparency.

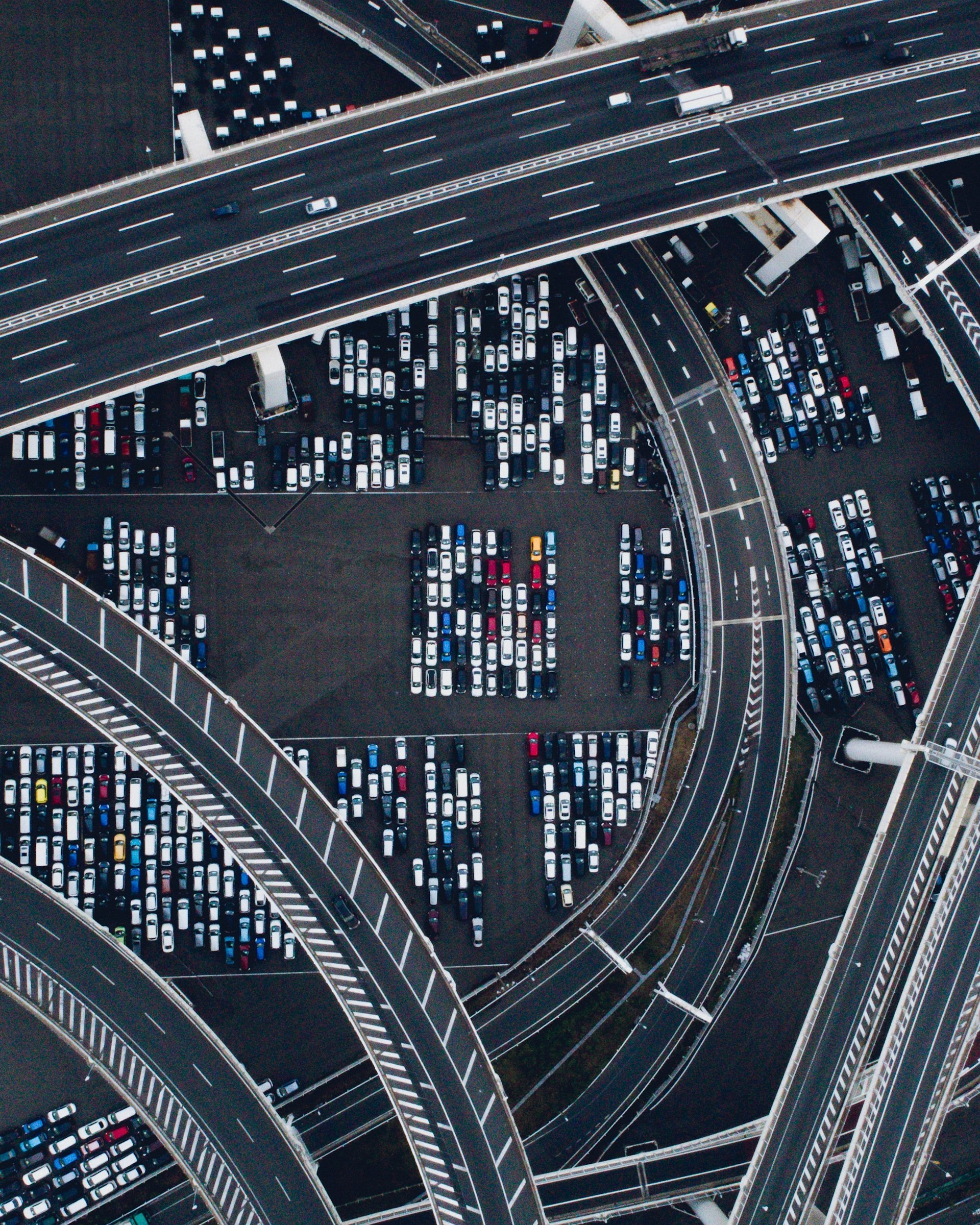

Photo by Aedrian Salazar on Unsplash

7. Accessing Guidance, Services, and Opportunities

If you are seeking to develop, audit, or enhance your algorithmic trading systems, several approaches can help you access the right expertise and resources:

- Engage with established trading technology vendors, ensuring they provide comprehensive support for risk management and compliance.

- Participate in industry conferences and workshops dedicated to algorithmic trading risk management. These events offer networking, best practice sharing, and updates on emerging threats.

- Consult with legal and regulatory experts who specialize in financial markets and algorithmic systems.

- For ongoing education, search for certified courses on algorithmic trading risk offered by reputable institutions. Use terms like “algorithmic trading risk management certification” or “financial technology compliance training.”

For regulatory updates, always refer to the official websites of agencies such as the SEC, CFTC, or your country’s equivalent financial regulator. When accessing industry standards, consult the FMSB, CFA Institute, or similar bodies for the latest statements and guidance.

Conclusion: Proactive Adaptation is Essential

The risks facing algorithmic trading systems are evolving as rapidly as the technology itself. Cybersecurity threats, market instability, technology failures, overfitting, and regulatory complexity all demand a proactive, multi-layered response. By staying informed, implementing robust controls, and fostering a culture of continuous improvement, trading firms and professionals can navigate the emerging risk landscape and safeguard their operations in 2025 and beyond.

References

- [1] uTrade Algos (2025). Algorithmic Trading Risks in 2025: Key Dangers & Risk Management.

- [2] Congressional Research Service (2025). Artificial Intelligence and Derivatives Markets: Policy Issues.

- [3] NURP (2025). The Future of Trading Algorithms: Trends and Predictions for 2025 and Beyond.

- [4] Michigan Journal of Economics (2025). Algorithmic Trading and Market Volatility: Impact of High-Frequency Trading.

- [5] FICC Markets Standards Board (2020). Statement of Good Practice on Algorithmic Trading.