Navigating the Rise of Decentralized Finance Platforms: Opportunities, Challenges, and Access

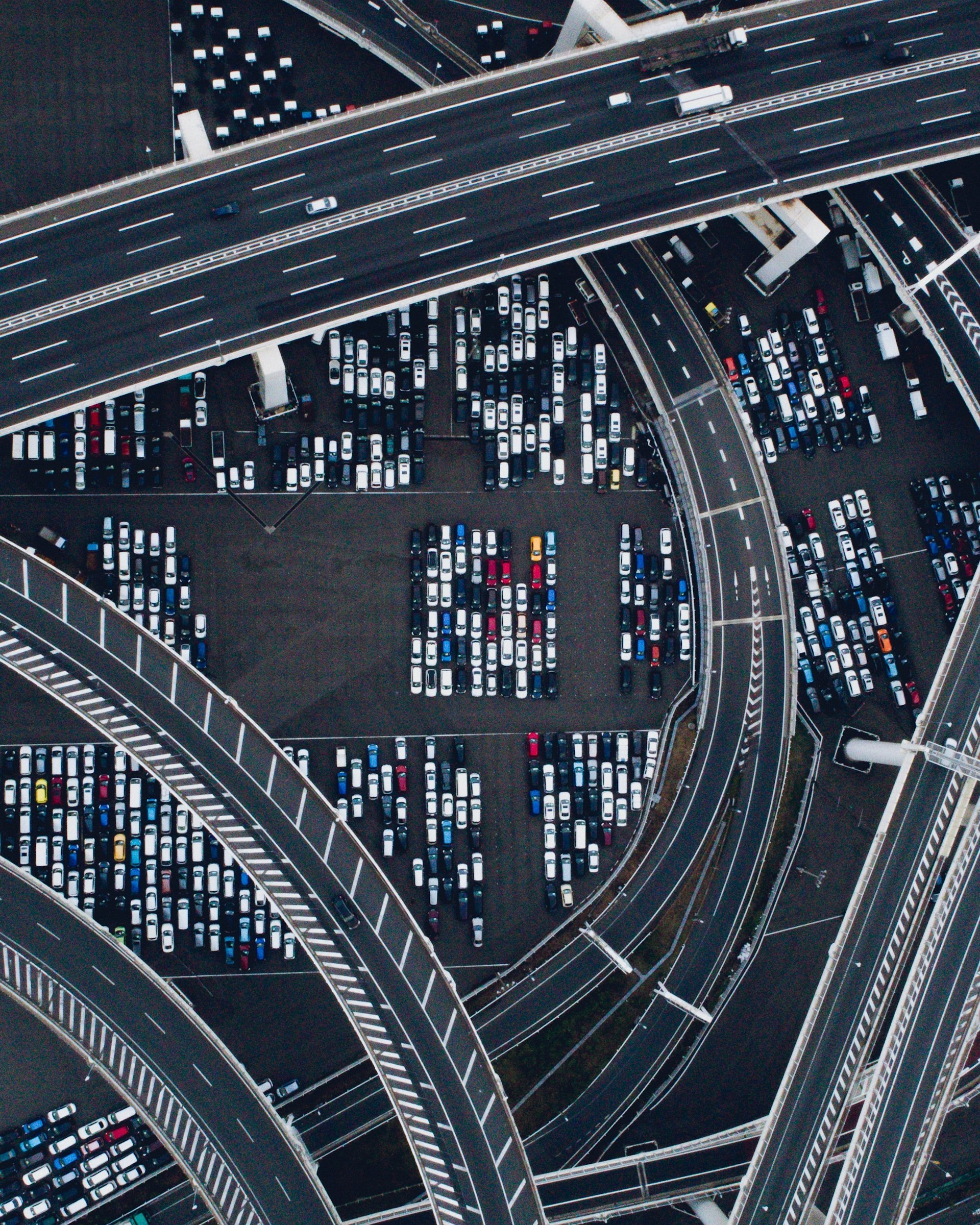

Photo by Anne Nygård on Unsplash

Introduction: The New Era of Decentralized Finance

Decentralized finance platforms have rapidly transformed the landscape of global finance. By leveraging blockchain technology and smart contracts, these systems offer direct, peer-to-peer access to lending, borrowing, trading, and more-eliminating the need for traditional banks and financial intermediaries. This shift has empowered millions to participate in a more open, transparent, and accessible financial ecosystem, reshaping how individuals and businesses manage, invest, and interact with digital assets. [1] [2]

What Are Decentralized Finance Platforms?

DeFi platforms are blockchain-based applications, predominantly built on Ethereum and similar smart contract networks, that enable users to access financial services without centralized oversight. Unlike traditional finance, where banks and institutions hold custody over funds and control access, DeFi platforms use open-source, auditable code to facilitate financial transactions directly between users. Key services include:

- Lending and borrowing of digital assets

- Decentralized exchanges (DEXs) for trading

- Staking and yield farming for earning interest

- Synthetic asset creation

- Decentralized stablecoins

Users maintain full control of their crypto assets at all times, thanks to the non-custodial nature of DeFi wallets and protocols. [2] [3]

How DeFi Differs from Traditional Finance

The most striking difference is the absence of intermediaries. In traditional systems, institutions like banks, exchanges, or brokers manage transactions, custody, and participation. In contrast, DeFi platforms run on smart contracts-self-executing agreements on public blockchains-which execute transactions and manage funds automatically. This means:

- Users interact directly with protocols, not companies

- Access is permissionless (no approval or account opening required)

- Funds are always under the user’s own custody via crypto wallets

This model offers greater transparency and control, but also places responsibility for security and risk management on the user rather than a third-party institution. [4] [5]

Key Benefits of DeFi Platforms

DeFi’s rapid growth is driven by several core advantages:

- Accessibility: Anyone with an internet connection and a crypto wallet can access DeFi platforms globally, bypassing geographic and regulatory barriers.

- Transparency: All transactions and smart contracts are recorded on public blockchains, allowing anyone to audit platform behavior and track funds.

- Programmability: Developers can build complex financial products and services, enabling innovation and composability between platforms.

- Inclusivity: DeFi opens financial services to the unbanked and underbanked, who are often excluded from traditional systems.

- Potentially Higher Returns: Some DeFi protocols offer higher interest rates or yields compared to conventional banks, though these come with increased risks. [2]

For example, in 2025, the DeFi market is projected to range from $26.94 billion to $86.53 billion in size, reflecting substantial growth and adoption. [2]

Risks and Challenges in DeFi

While DeFi presents compelling opportunities, it is also marked by unique risks and challenges that participants must consider:

- Smart Contract Vulnerabilities: Bugs or flaws in contract code can be exploited, sometimes leading to loss of funds. Users are encouraged to favor platforms that have undergone thorough third-party audits and maintain active security practices. [5]

- Lack of Regulatory Safeguards: DeFi operates outside conventional regulatory frameworks, meaning there are no government-backed protections or recourse in the event of loss.

- Market Volatility: Prices of cryptocurrencies and tokens can fluctuate wildly, affecting the value of assets and returns.

- User Accountability: Users must manage private keys and wallet security themselves. Loss of keys typically means irreversible loss of funds. [4]

Before engaging with DeFi platforms, it is essential to conduct thorough research, start with small amounts, and follow best security practices.

How to Access Decentralized Finance Platforms: Step-by-Step Guidance

Getting started with DeFi involves several concrete steps. Here’s a practical approach for new users:

- Educate Yourself: Begin by researching DeFi basics-understand how blockchain, smart contracts, and crypto wallets work. Many reputable online courses and communities offer introductory materials.

- Choose a Secure Wallet: Select a cryptocurrency wallet that supports DeFi applications (such as MetaMask, Trust Wallet, or Ledger). Set up your wallet and securely store your recovery phrase.

- Acquire Cryptocurrency: Purchase cryptocurrency (typically Ethereum or other supported assets) through a reputable exchange. Transfer funds from the exchange to your personal wallet address.

- Select a DeFi Platform: Identify platforms that match your interests-such as lending, trading, or staking. For example, you can review independent lists of top DeFi platforms for current recommendations. [2]

- Connect Your Wallet: Use your wallet to connect to the chosen DeFi platform (typically via the platform’s website interface). Always verify you are on the official site before connecting.

- Test with Small Amounts: Begin by interacting with small sums to familiarize yourself with the interface and confirm that transactions work as expected.

- Monitor Risks: Stay updated on platform audits, community feedback, and security advisories. Diversify your activities to avoid over-exposure to any single protocol.

Note: As the DeFi landscape evolves, new platforms and services continue to emerge. Always refer to reputable industry news sources and official platform documentation for the latest updates and guidance.

Real-World Applications and Use Cases

DeFi platforms are no longer experimental. Billions of dollars move through these systems daily, with applications that include:

- Decentralized Exchanges (DEXs): Users can swap cryptocurrencies directly without intermediaries, often at lower fees and with greater privacy.

- Lending and Borrowing Protocols: Platforms allow users to lend their assets to earn interest or borrow against collateral, providing liquidity and access to capital.

- Stablecoins: Crypto tokens pegged to traditional currencies (like USD) enable price stability for trading and transacting.

- Insurance: Decentralized insurance platforms offer coverage against risks like smart contract failure or hacks.

- Decentralized Autonomous Organizations (DAOs): Community-led governance models manage funds and protocol updates transparently.

For example, decentralized exchanges and lending protocols like those listed in current industry reports have seen adoption by both retail and institutional users. [2]

Accessing DeFi Opportunities: Practical Steps and Alternatives

If you are interested in participating in DeFi, here are alternative pathways and strategies:

- Research platforms that have undergone independent audits and maintain active communities. Look for transparency in operations and clear, accessible documentation.

- Consider starting with platforms that have been established for several years and have a track record of security and reliability.

- If you are unsure about a specific platform’s legitimacy, search for reviews and tutorials from trusted industry news sites, and consult online DeFi communities for up-to-date recommendations.

- For newcomers, some wallets and exchanges offer educational resources and test networks (testnets) where you can practice transactions with simulated assets before risking real funds.

- If you have questions or need support, many DeFi platforms provide community forums, official social media channels, and help centers. Search for the platform’s official website or verified social profiles for assistance.

- Always use two-factor authentication and hardware wallet options where available to enhance the security of your digital assets.

If you are seeking the most current DeFi opportunities, you can search for “top DeFi protocols 2025” or “best decentralized finance platforms” using reputable industry sources or blockchain analytics providers.

Photo by Markus Spiske on Unsplash

Potential Challenges and Solutions

Engaging with DeFi platforms presents several challenges, including technical complexity, high volatility, and evolving regulation. Overcoming these obstacles requires continual learning, caution, and community involvement. Users are encouraged to stay informed, diversify their exposure, and never invest more than they can afford to lose.

If you encounter difficulties, many blockchain communities on public forums and social media provide peer-to-peer support and troubleshooting advice. When in doubt, start with smaller transactions and gradually increase your participation as your confidence and understanding grow.

Summary: Key Takeaways for DeFi Participation

Decentralized finance platforms are revolutionizing access to financial services, creating new opportunities for earning, trading, and borrowing. However, this innovation comes with increased user responsibility and risk. By educating yourself, following security best practices, and leveraging community resources, you can navigate the evolving DeFi ecosystem safely and effectively.

References

- [1] Paystand (2024). Decentralized Finance (DeFi): The Future of Finance.

- [2] iLink (2025). Best DeFi Platforms in 2025: Top Decentralized Finance Protocols for Earning, Trading, and Lending.

- [3] MadDevs (2025). Everything You Need to Know About DeFi Platforms in 2025.

- [4] G2 Learning Hub (2025). Decentralized Finance in 2025: Know the Risks and Rewards.

- [5] Wikipedia (2025). Decentralized finance.