The Future of Digital Gold Investment Platforms: Trends, Opportunities, and Practical Guidance

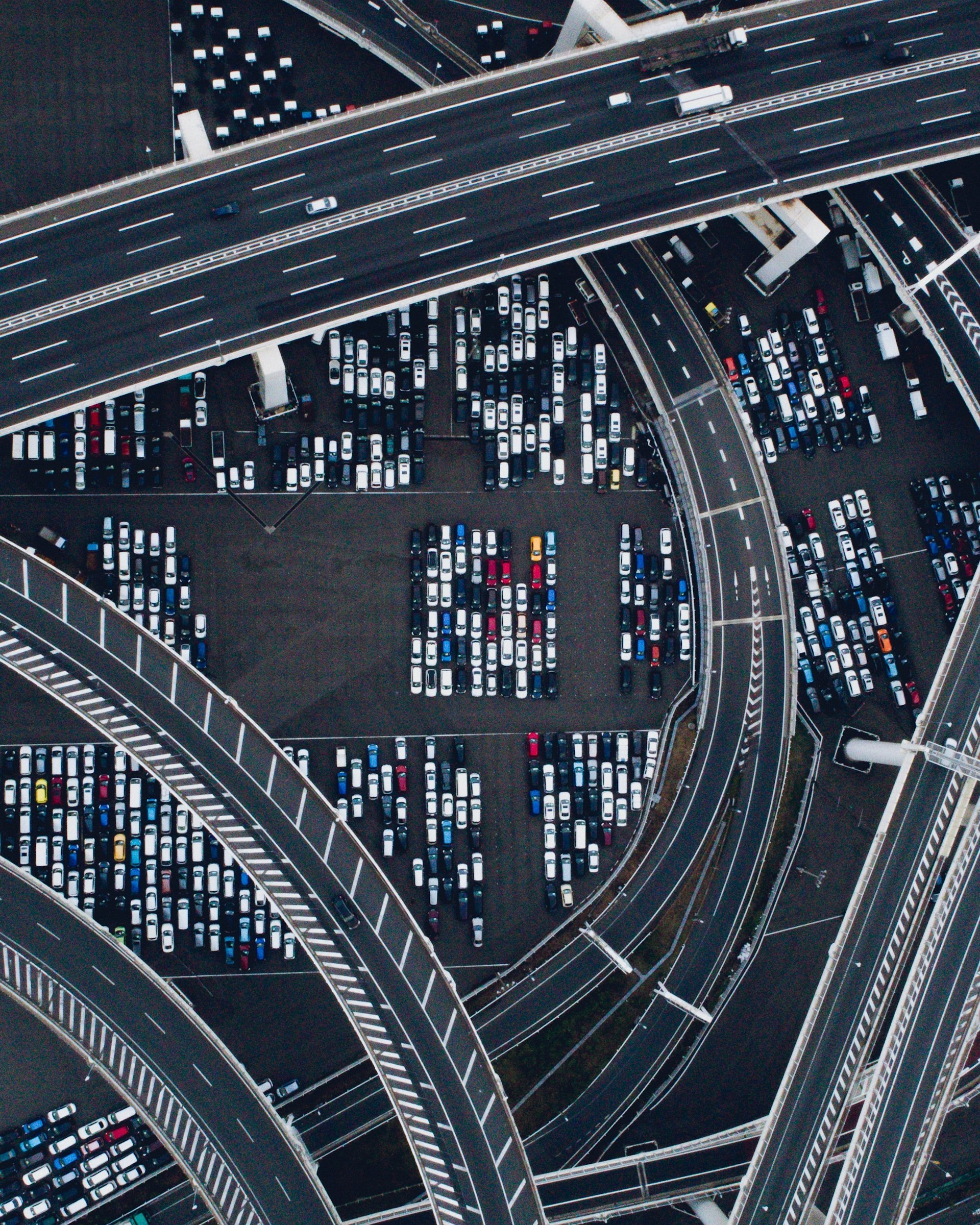

Photo by Ferhat Deniz Fors on Unsplash

Introduction: Digital Gold’s Evolving Role in Modern Portfolios

As the world becomes more digital, investment strategies are evolving to meet the needs of modern investors. Digital gold investment platforms have emerged as a secure, accessible, and technologically advanced alternative to traditional gold ownership. These platforms allow individuals to buy, hold, and sell gold in fractional amounts without the burdens of physical storage or security risks. In 2025, digital gold continues to gain traction among both experienced and new investors, offering a blend of historical value and contemporary convenience [1] .

Section 1: What Are Digital Gold Investment Platforms?

Digital gold platforms facilitate the purchase, storage, and management of gold in digital form. When users buy digital gold, they are acquiring a claim on physical gold securely stored in professional vaults, managed by trusted custodians. The investor can track, buy, or sell their holdings online at any time. Some platforms also provide options to convert digital gold into physical gold or cash, depending on the investor’s preference [5] .

For those seeking to access these services, you can begin by researching digital gold investment providers that are regulated and have transparent custodial agreements. Before opening an account, review user feedback, platform security features, and whether the platform supports options such as systematic investment plans (SIPs) or direct conversion to physical gold.

Section 2: Key Benefits and Features Driving Growth

Digital gold platforms are growing in popularity due to a combination of accessibility, security, and flexibility:

- Accessibility: Investors can start with small amounts, making gold investment feasible for a broader demographic, including young and first-time investors. Fractional ownership means there’s no need to purchase entire gold bars or coins [1] .

- Security: Digital gold is fully backed by physical gold stored in high-security vaults. Investors avoid the challenges of home storage and insurance [5] .

- Liquidity: Digital platforms usually provide instant buy/sell options, allowing for rapid adjustments to portfolios in response to market conditions.

- Transparency: Many platforms publish regular audits, ensuring that every digital unit is backed by real gold. This transparency builds trust among users.

- Technological Integration: Innovations such as AI-driven portfolio management and blockchain-based tokenization are enhancing user experience and operational reliability [2] [4] .

Section 3: Market Trends and Forecasts for 2025 and Beyond

Industry forecasts suggest that digital gold will continue to be a key element in diversified portfolios. Predictive models and expert analysis indicate that gold prices are likely to rise in 2025, driven by global economic uncertainty, central bank accumulation, and technological disruption [2] . For example, some analysts predict returns in the range of 10-12% for gold investments in 2025 [1] .

Technology is playing an increasingly critical role. AI-powered tools adjust gold allocations in real time, helping investors optimize their positions as market conditions change. Blockchain is also enabling the tokenization of gold, which makes it easier to trade and allows for fractional ownership, increasing liquidity and lowering barriers to entry [4] .

Investors interested in riding these trends should focus on platforms that offer robust digital tools, transparent pricing, and regulated custody services. It’s possible to monitor performance, set up automatic investments, and access up-to-the-minute market data through these systems.

Section 4: Sustainability and Ethical Sourcing

In 2025, there is heightened attention on the environmental and ethical impact of gold mining and sourcing. Many digital gold platforms now emphasize their commitment to responsible sourcing, using gold from suppliers who meet strict environmental and labor standards [4] . This trend is especially important for investors who want their portfolio to align with ESG (Environmental, Social, and Governance) values.

Before investing, consider reviewing the platform’s sustainability disclosures. Look for information on supply chain audits, certifications, and partnerships with responsible miners. While not every platform provides the same level of detail, prioritizing those that are transparent about their sourcing can help align your investments with your ethical standards.

Photo by Rainer Gelhot on Unsplash

Section 5: Practical Steps for Accessing Digital Gold Investments

If you want to invest in digital gold, follow these practical steps:

- Research and compare regulated digital gold platforms. Focus on providers with transparent terms, verified audits, and secure vaulting arrangements. Examples of platforms discussed in industry analysis include Jar App and other regulated gold investment providers [1] .

- Register for an account, providing the necessary identification and banking details. Ensure that the platform complies with local regulations and offers robust security protocols.

- Decide on an investment strategy. Many platforms allow for systematic investment plans (SIPs), where a set amount is invested at regular intervals, enabling dollar-cost averaging and disciplined accumulation.

- Monitor your portfolio through the platform’s dashboard. Use analytical tools to track performance, rebalance your portfolio, and set up alerts for price changes.

- Understand your exit options. Digital gold can typically be sold back for cash, converted into physical gold, or redeemed as jewelry, depending on the platform’s offerings.

If you are unsure where to start, you can search for “regulated digital gold platforms” and review user feedback, comparison articles, and official platform websites for the latest features and compliance standards. For those interested in sustainability, search for “ESG digital gold platforms” or review the provider’s sustainability and sourcing policies.

Section 6: Challenges and Considerations

While digital gold investment platforms offer numerous advantages, there are important considerations:

- Regulatory Oversight: Ensure that your chosen platform is regulated by a recognized financial authority. Regulatory standards vary across regions, affecting investor protections.

- Fees and Costs: Digital gold may involve storage fees, transaction costs, or spreads between buy and sell prices. Review all fees before investing.

- Liquidity: While most platforms offer high liquidity, redemption times and methods may vary. Always check withdrawal policies and timelines.

- Market Volatility: Gold prices can fluctuate due to macroeconomic factors, including currency movements, geopolitical events, and changes in central bank policies. Use risk management strategies, such as diversified allocations and regular reviews.

- Platform Security: Choose platforms with strong encryption, regular audits, and published security protocols to mitigate the risk of cyber threats and fraud.

To address these challenges, always conduct thorough due diligence. Consider consulting with a financial advisor who is familiar with digital assets and precious metals. If you encounter uncertainty about a platform’s legitimacy, refer to official financial regulatory agency websites for up-to-date lists of licensed providers.

Section 7: Alternative Approaches and Future Outlook

Beyond standard digital gold platforms, investors may explore alternatives such as gold-backed ETFs, blockchain gold tokens, or even direct investments in gold mining ventures. Each approach has distinct benefits and risks:

- Gold-backed ETFs: Trade on public exchanges and offer exposure to gold price movements, but may not provide direct claims on physical gold.

- Blockchain Tokens: Offer transparency and fractional ownership, often suited for tech-savvy investors [4] .

- Gold Mining Investments: Provide exposure to the growth of gold production and prices, especially in regions adopting new technology and sustainable practices [3] .

As technology advances and regulations develop, digital gold investment platforms are expected to become even more secure, accessible, and integrated with broader financial ecosystems. Investors should stay informed about new features, regulatory updates, and market conditions to maximize their potential returns and manage risks effectively.

Conclusion

Digital gold investment platforms are reshaping how individuals access and manage gold in their portfolios. By combining the enduring value of gold with the advantages of digital technology, these platforms offer a flexible, transparent, and secure pathway to wealth preservation. Whether you are a seasoned investor or new to precious metals, understanding the evolving landscape, leveraging technology, and practicing due diligence can help you make the most of these innovative opportunities in 2025 and beyond.

References

[1] Jar App (2025). Is Digital Gold a Good Investment for 2025? [2] AIJourn (2025). How AI Is Shaping Small Gold Bar Investments in 2025 [3] Farmonaut (2025). Investment Opportunities In Gold Mining: 2025 Trends [4] Asia Commodity Market (2025). Gold and Silver Investing Trends in 2025 [5] Wholesale Coins Direct (2025). Digital Gold in the USA | Exploring Digital Gold Platforms