Unlocking Efficiency and Trust: Blockchain Solutions in Supply Chain Finance

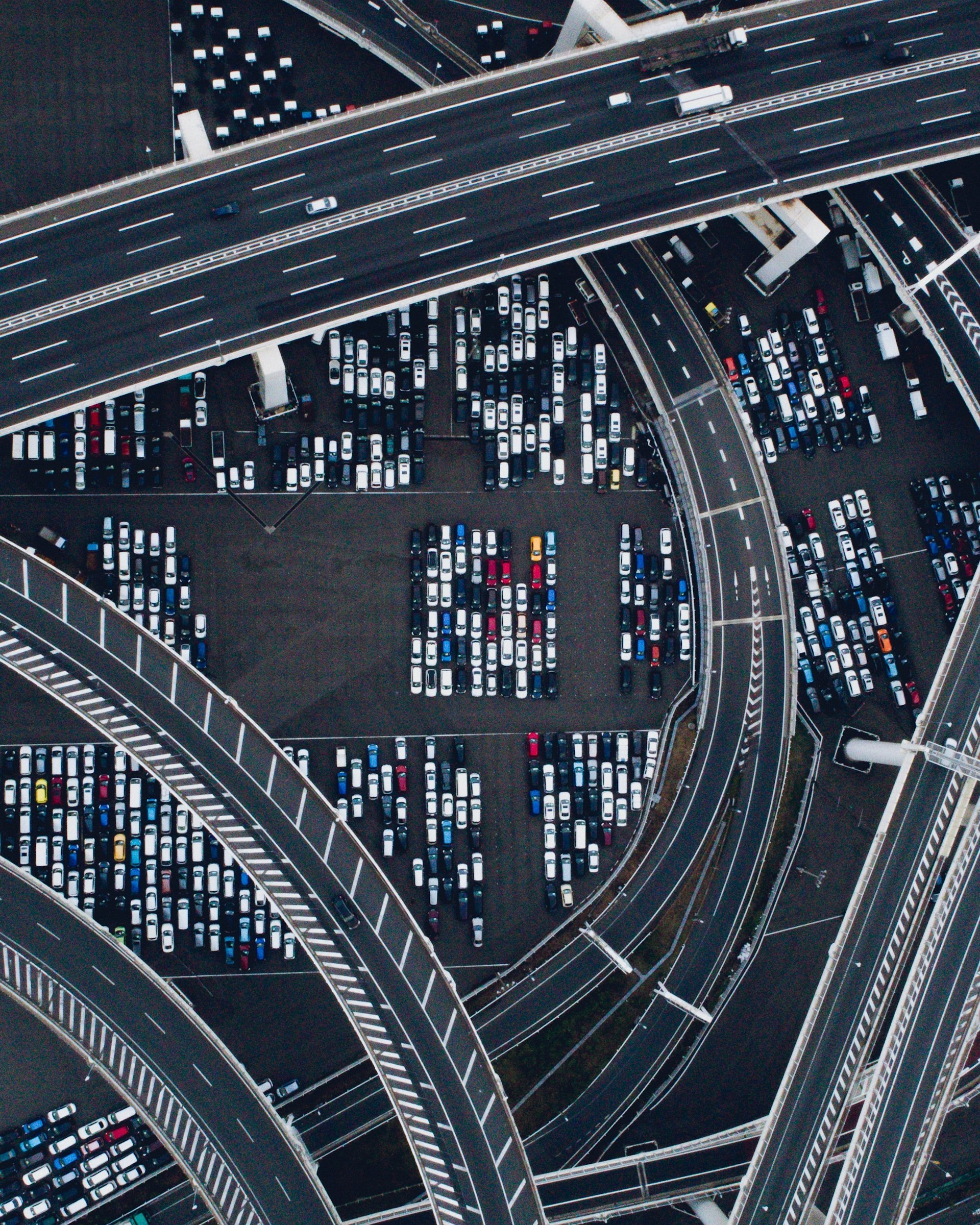

Photo by Chris Henry on Unsplash

Introduction

Supply chain finance (SCF) plays a pivotal role in ensuring the smooth flow of goods and capital between buyers, suppliers, and financial institutions. Traditionally, SCF processes have been hampered by inefficiencies, limited transparency, and high risk-especially for small and medium-sized enterprises (SMEs). Blockchain technology offers a transformative solution, promising enhanced security , visibility , and process automation that can significantly improve outcomes for all parties involved [1] [2] .

How Blockchain Works in Supply Chain Finance

Blockchain is a distributed ledger system where all parties can access, validate, and share data in real time. In SCF, this means every transaction-from purchase orders to payments and loan settlements-is recorded as an immutable block, creating a transparent and tamper-resistant history [1] . For example, when a buyer places an order, the supplier, lender, and buyer each gain instant visibility into every step of the process, including funding requests, shipping, invoicing, payments, and loan repayments. This automation eliminates manual interventions, reduces errors, and ensures that all stakeholders have a single source of truth [1] .

Key Benefits of Blockchain in Supply Chain Finance

1. End-to-End Visibility

A major challenge in traditional SCF is information asymmetry , where lenders and buyers lack full visibility into supplier operations. Blockchain solves this by providing real-time access to trade data, shipment status, and payment history, dramatically reducing the risk of fraud and duplicate payments [2] . Platforms like Tradelens already demonstrate how blockchain ecosystems enable real-time tracking of goods and documents, facilitating more accurate credit risk assessments.

2. Risk Mitigation and Credit Evaluation

Blockchain’s transparency helps financial institutions better evaluate supplier creditworthiness. With every transaction securely recorded and accessible, lenders can dynamically assess risk, even for previously unacknowledged applicants such as SMEs. This can lead to more favorable loan terms and greater access to capital [3] . Smart contracts, self-executing pieces of code stored on the blockchain, further automate loan disbursement and repayment, reducing costs and delays [3] .

3. Process Efficiency and Cost Reduction

By automating key processes-such as funding requests, order validation, shipping updates, and invoice settlements-blockchain reduces administrative costs and minimizes human error. This not only speeds up transactions but also lowers financing costs for suppliers and retailers. The result is a more agile and robust supply chain, capable of responding quickly to market changes [1] [2] .

Real-World Example: Blockchain in Action

Consider a scenario where a global retailer orders packaging materials from a local manufacturer. The entire transaction is managed on a blockchain:

- The retailer places an order, which is recorded on the blockchain.

- The manufacturer requests funding for raw materials; the bank reviews and approves the request, adding a new block.

- Production, shipping, invoicing, and payment are all tracked in real time, with each step recorded as a block.

- The manufacturer repays the loan, and the chain is closed, providing an immutable record visible to all parties [1] .

This approach eliminates delays, reduces costs, and increases trust and participation among lenders.

Implementing Blockchain in Your Supply Chain Finance Strategy

If you are considering blockchain integration for SCF, follow these steps:

- Assess Your Needs: Identify pain points in your current supply chain finance processes, such as lack of visibility, high costs, or frequent disputes.

- Choose the Right Platform: Research established blockchain platforms with proven SCF applications. If you seek real-time tracking and document management, consider platforms like Tradelens for container logistics [2] .

- Engage Stakeholders: Ensure buy-in from suppliers, buyers, and financial institutions. Collaboration is critical for maximizing blockchain benefits.

- Start Small: Pilot blockchain solutions with a limited set of transactions or supply chain partners. Monitor results and gather feedback.

- Expand and Integrate: Scale successful pilots to broader operations. Integrate blockchain with existing technologies such as IoT and AI for enhanced automation and predictive analytics [5] .

For further guidance, consider consulting reputable supply chain technology advisors or industry organizations. Alternatively, search for “blockchain supply chain finance consulting” or “blockchain SCF platforms” to identify available service providers.

Challenges and Solutions

While blockchain offers significant advantages, several challenges remain:

- Adoption Barriers: Some organizations may be reluctant to change established processes. Overcome resistance by demonstrating clear benefits and conducting pilot projects.

- Platform Usage Thresholds: Research shows blockchain-driven SCF is most beneficial when platform usage rates are below a certain threshold. Monitor adoption rates and optimize participation accordingly [4] .

- Integration Complexity: Seamlessly integrating blockchain with legacy systems can require substantial technical effort. Work with experienced IT professionals and prioritize interoperability.

- Regulatory Considerations: Compliance with local and international regulations is essential. Stay informed about regulatory changes affecting digital finance and supply chain operations.

Many organizations address these challenges by starting with small-scale pilots and gradually expanding their blockchain initiatives, leveraging external expertise when needed.

Alternative Approaches

If full blockchain integration is not feasible, consider hybrid solutions:

- Permissioned Blockchains: These allow selected participants within a supply chain to access and validate transactions, balancing transparency with privacy [5] .

- Smart Contracts: Implement smart contracts on existing platforms to automate specific financial processes, such as invoice validation or payment release [3] .

- Digitized Document Management: Use blockchain for critical document management while maintaining traditional systems for other processes.

To explore these alternatives, consult with technology advisors or search for “blockchain smart contracts supply chain” and “permissioned blockchain solutions” to find providers with relevant expertise.

Accessing Blockchain Supply Chain Finance Services

To access blockchain-driven SCF services or solutions, you can:

- Contact established consultancies such as Deloitte for blockchain supply chain innovation services [5] .

- Search online using terms like “blockchain supply chain finance platform” to locate verified vendors and platforms.

- Reach out to your current financial institution to inquire about blockchain-enabled financing options.

- Join industry forums or professional associations focused on supply chain technology for peer recommendations.

When contacting providers or exploring solutions, request case studies, pilot program details, and references to ensure the platform’s legitimacy and effectiveness.

Conclusion

Blockchain technology is reshaping supply chain finance by delivering unparalleled transparency, reducing risk, and streamlining operations. By leveraging real-time data, automating key processes, and enhancing trust among stakeholders, businesses can achieve greater efficiency and improved access to capital. While challenges exist, a strategic approach to implementation-starting with pilot projects and expanding gradually-can unlock significant value. For organizations seeking to adopt blockchain in supply chain finance, verified consultancies, experienced technology providers, and industry associations offer valuable support and guidance. Always confirm the legitimacy of any platform or service before committing resources, and consult multiple sources for the latest best practices and regulatory updates.

Photo by Markus Winkler on Unsplash

References

- [1] Swoop UK (2024). Blockchain technology in supply chain finance.

- [2] PMC (2022). Blockchain and supply chain finance: a critical literature review.

- [3] University of Chicago Knowledge (2022). Blockchain-Enabled Utility Optimization for Supply Chain Finance.

- [4] Wiley Online Library (2023). Blockchainâ€Driven Supply Chain’s Financing and Coordination Strategy.

- [5] Deloitte (2024). Using blockchain to drive supply chain transparency.