Unlocking Financial Success: Harnessing Artificial Intelligence in Financial Planning

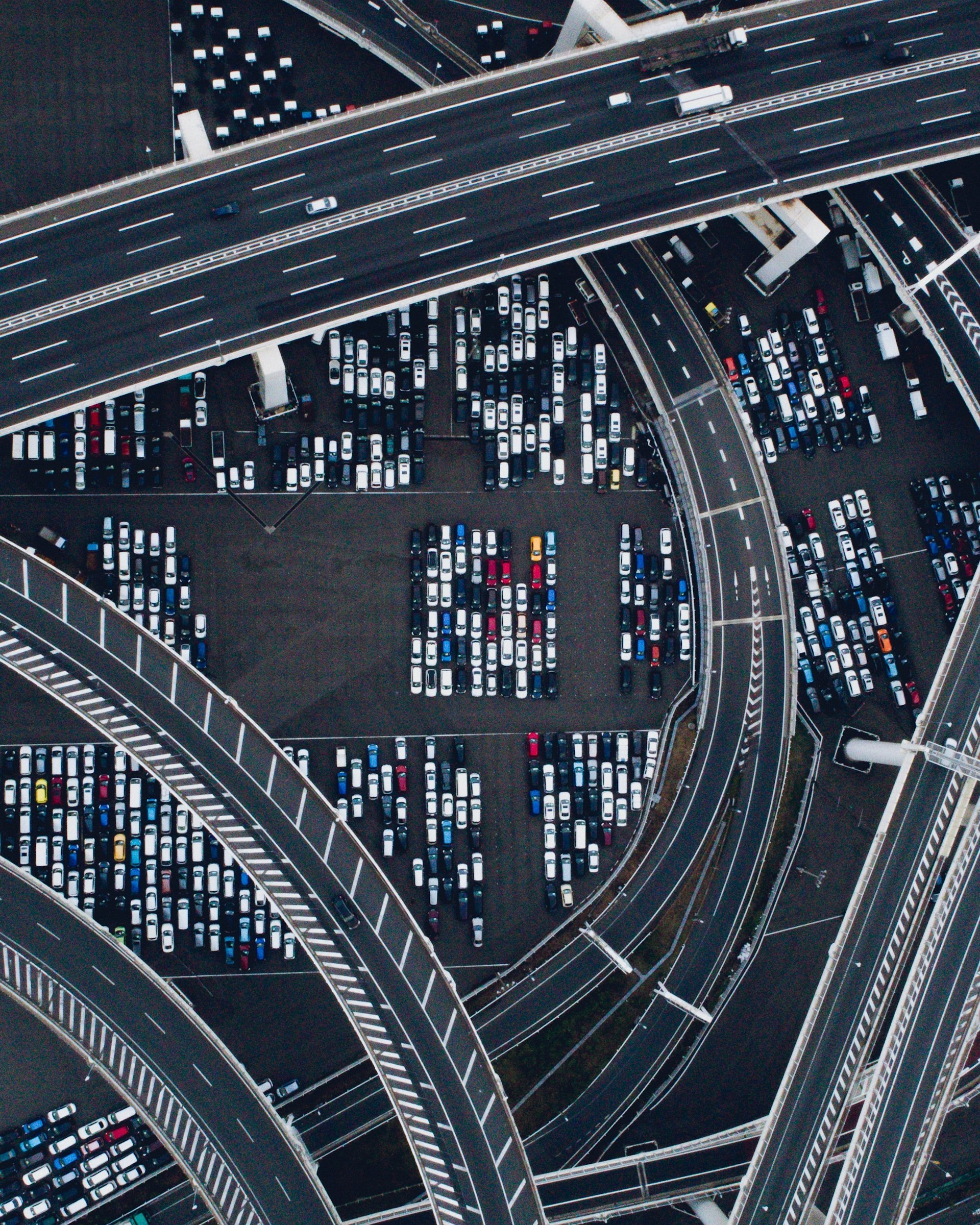

Photo by Arthur A on Unsplash

Introduction: The Rise of Artificial Intelligence in Financial Planning

Artificial intelligence (AI) is rapidly changing the landscape of financial planning. By leveraging machine learning, predictive analytics, and automation, AI-powered solutions are enabling individuals and organizations to make faster, more informed, and more personalized financial decisions. As AI technology continues to evolve, its role in financial planning is becoming increasingly central, offering benefits such as improved efficiency, accuracy, and accessibility. This article explores how AI is transforming financial planning, highlighting practical applications, real-world examples, actionable steps for implementation, and important considerations for responsible use.

Core Applications of AI in Financial Planning

AI-driven technologies are impacting nearly every aspect of financial planning. Key areas of application include:

1. Risk Management and Monitoring

AI systems analyze vast amounts of historical financial data and real-time market trends to proactively identify emerging risks. For example, AI can spot patterns of risky lending or investment activities and update risk forecasts as new information becomes available. This dynamic risk assessment helps reduce financial exposure and enables quicker, more confident decision-making for activities such as lending, investing, or client onboarding. Companies adopting AI for risk management can respond more effectively to market volatility and regulatory shifts, ultimately safeguarding assets and enhancing long-term stability [1] .

2. Predictive Analytics and Forecasting

AI enhances the accuracy of revenue, cash flow, and cost forecasts by incorporating real-time data, seasonality, consumer behavior, and external market variables. Predictive models allow financial planners to anticipate market changes and adjust strategies proactively, minimizing surprises and optimizing returns. CFOs and advisors gain greater confidence in budgets and investor communications by relying on data-driven projections rather than outdated models [1] [2] .

Photo by Steve Johnson on Unsplash

3. Fraud Detection and Prevention

AI-powered fraud detection systems monitor transactions in real-time to identify suspicious activity and prevent financial crimes. According to recent industry reports, AI can detect fraud with an accuracy rate between 87% and 94%, while reducing false positives by 40-60%. This technology is vital for protecting clients from phishing, identity theft, and unauthorized transactions, and is increasingly being adopted by banks and financial institutions worldwide [1] .

4. Credit Scoring and Lending Decisions

Traditional credit scoring models often overlook valuable data, leading to unfair or inaccurate lending decisions. AI-powered systems analyze a broader array of financial and behavioral data, resulting in more accurate and inclusive credit scores. This reduces loan defaults, speeds up approval processes, and provides faster feedback for customers seeking credit or mortgages [1] .

5. Personalization and Client Engagement

AI enables highly personalized financial advice by analyzing individual client behavior, financial goals, and risk tolerance. Robo-advisors and AI-driven platforms can generate customized investment strategies, adjust plans in real time, and provide 24/7 support through chatbots and virtual assistants. This level of personalization enhances the client experience, increases engagement, and allows financial advisors to serve more clients efficiently without sacrificing quality [2] [3] .

6. Regulatory Compliance and Documentation

AI automates documentation, tracks regulatory changes, and ensures adherence to financial laws. Planners can use these tools to stay current with compliance requirements, reducing legal risks and streamlining reporting. Automated compliance also minimizes manual errors and saves time for organizations with complex regulatory obligations [2] .

Generative AI: A New Era for Goal-Based Financial Planning

Generative AI is further advancing the field by enabling the creation of tailored, goal-based financial plans. It helps clients identify and prioritize financial goals, assesses risks using sophisticated analytics, and delivers actionable, highly personalized recommendations. By simplifying complex financial concepts and generating clear, visual reports, generative AI empowers clients to understand their options and make more informed decisions. Additionally, conversational AI interfaces (such as chatbots) make financial guidance more accessible, especially for those new to investing or retirement planning [4] .

Practical Steps for Implementing AI in Financial Planning

For individuals and organizations interested in leveraging AI for financial planning, the following steps can help ensure effective adoption:

- Assess Your Needs: Identify which areas of your financial planning process could benefit most from AI-such as forecasting, compliance, or client engagement.

- Evaluate AI Tools: Research available AI solutions. Look for established providers with a track record in financial services. You can consult industry reports or reputable financial technology publications for up-to-date reviews and case studies.

- Start with Pilot Projects: Implement AI on a small scale first. For example, introduce an AI-driven chatbot to handle common client questions, or use AI analytics for risk assessment in a single department.

- Ensure Data Quality and Security: AI is only as reliable as the data it processes. Regularly audit data sources for accuracy and ensure compliance with data privacy regulations. Discuss security protocols with any technology vendor.

- Integrate Human Judgment: AI can support but not replace human expertise. Always review AI-generated recommendations and apply professional judgment, especially for complex or high-stakes decisions [5] .

- Educate and Train Your Team: Provide training on how to use AI tools effectively and responsibly. Financial professionals should understand both the capabilities and limitations of AI.

- Monitor and Refine: Continuously track AI system performance. Gather feedback from users and clients, and make adjustments as needed to improve accuracy and user experience.

Examples and Case Studies

Many financial organizations are successfully integrating AI into their planning processes:

- Major banks use AI to automate loan approvals, reducing processing times and improving the fairness of credit decisions.

- Investment firms leverage AI to optimize portfolio management, increase forecasting accuracy, and provide clients with real-time insights and scenario modeling tools.

- Retirement planning platforms utilize AI to suggest optimal savings rates, analyze spending patterns, and recommend personalized investment strategies for long-term goals.

For those interested in exploring specific AI solutions, you can review technology vendor ratings and industry analyses published by reputable financial industry organizations. If you are seeking AI-driven financial planning tools as an individual, consider consulting your financial advisor and asking about their technology stack or searching for “AI financial planning platforms” through established financial technology review sites.

Challenges, Risks, and Responsible Use

While AI offers many benefits, it also presents unique challenges:

- Accuracy and Consistency: AI recommendations may vary based on data quality and algorithmic limitations. Use AI as a starting point, and always cross-verify important decisions with trusted professionals [5] .

- Privacy and Security: Protecting sensitive financial data is paramount. Ensure any AI solution you use adheres to strict security standards and complies with relevant regulations.

- Personalization Limits: While AI can provide tailored advice, it may not fully understand unique personal circumstances or emotional considerations. Human oversight remains necessary, especially for complex life events or atypical financial situations.

- Bias and Transparency: AI systems can inherit biases from historical data. Regularly audit AI outputs, and seek transparent solutions that allow you to understand how decisions are made.

Financial planners and individuals are encouraged to use AI as a complement to-rather than a replacement for-human expertise, ensuring the best outcomes for both typical and unique financial goals.

Accessing AI-Driven Financial Planning Services

If you are interested in AI-powered financial planning tools:

- Individuals: You can ask your current financial advisor about AI-driven options or search online for “AI financial planning platforms.” Look for solutions reviewed by reputable financial publications or regulatory bodies.

- Organizations: To explore enterprise-grade solutions, consult financial technology analysts, read industry case studies, and request references from vendors before deploying new tools.

For all users, it is recommended to start with a needs assessment and pilot project, consult with IT and compliance teams, and prioritize solutions with proven track records in the financial sector.

Conclusion

Artificial intelligence is redefining financial planning, empowering individuals and organizations with advanced analytics, fraud prevention, and personalized advice. While the technology presents challenges, its potential benefits are significant-when implemented thoughtfully and responsibly. By combining AI-driven insights with human expertise, users can unlock new opportunities for financial success and security.

References

- RTS Labs (2024). AI in Financial Planning: Use Cases, Benefits, and Adoption Tips.

- NAIFA (2024). The Future of Financial Planning with the Use of Artificial Intelligence.

- MindBridge (2024). AI in Financial Planning: The CFO’s Guide to Strategic Decision Making.

- Hexaware (2024). Generative AI in Financial Services for Goal-based Planning.

- John Hancock Retirement (2024). How to Use Artificial Intelligence in Financial Planning.