Unlocking Greater Returns: Proven Strategies for Tax-Efficient Investing

Photo by Markus Winkler on Unsplash

Introduction: Why Tax Efficiency Matters in Investing

Paying attention to the tax consequences of your investment decisions can make a significant difference in your long-term returns. Taxes can erode a portion of your gains if not managed proactively, making it essential for investors to develop tax-efficient investment strategies that align with their goals and risk tolerance. Fortunately, there are proven methods and tools available to help investors maximize after-tax returns and minimize unnecessary tax payments. This article explores the most effective, actionable strategies and provides guidance on how to access these opportunities.

Understanding Taxable vs. Tax-Advantaged Accounts

One of the foundational steps in tax-efficient investing is understanding the types of accounts available, and how to use them strategically. Tax-advantaged accounts like 401(k)s, IRAs, Roth IRAs, 529 plans (for education savings), and Health Savings Accounts (HSAs) offer potential tax benefits. Contributions to traditional 401(k)s and IRAs may be tax-deductible, allowing investments to grow tax-deferred until withdrawal. Roth IRAs and Roth 401(k)s allow for tax-free withdrawals in retirement if specific conditions are met [2] . HSAs, if used for qualified medical expenses, provide a triple tax advantage: contributions are pre-tax or deductible, grow tax-free, and can be withdrawn tax-free for eligible expenses [3] .

To optimize your tax situation, you can:

- Maximize contributions to tax-advantaged accounts up to IRS limits

- Use taxable accounts for investments that are already tax-efficient or benefit from lower long-term capital gains rates

- Periodically review your account allocations to adapt to changes in tax law or personal circumstances

For up-to-date contribution limits and eligibility, visit the IRS website or consult a tax professional. Most financial institutions provide resources and calculators to help you maximize your contributions each year.

Asset Placement: Putting the Right Investments in the Right Accounts

Not all investments are taxed equally. Asset placement involves allocating investments among taxable, tax-deferred, and tax-free accounts to reduce your overall tax burden. For example, investments that generate high levels of taxable income (such as taxable bonds or actively managed funds with frequent trading) are typically best held in tax-deferred accounts like traditional IRAs or 401(k)s. Conversely, investments that are inherently tax-efficient, such as index funds, exchange-traded funds (ETFs), and municipal bonds, can be placed in taxable accounts [1] [5] .

Here’s a simple step-by-step approach:

- List all your investment accounts, and categorize them as taxable, tax-deferred, or tax-free.

- Identify which holdings generate ordinary income, short-term gains, or qualified dividends.

- Allocate tax-inefficient assets (e.g., taxable bonds, REITs, high-turnover funds) to tax-advantaged accounts.

- Place tax-efficient assets (e.g., ETFs, index funds, municipal bonds) in taxable accounts, taking advantage of lower long-term capital gains rates and potential tax exemptions.

For a more personalized asset placement strategy, consider working with a certified financial planner or tax advisor. Many wealth management firms offer tailored advice based on your unique situation.

Choosing Tax-Efficient Investments

The structure of your investments influences how much you pay in taxes each year. Tax-efficient investments are designed to minimize taxable distributions. Examples include:

- Index funds and ETFs: These tend to have low turnover, resulting in fewer taxable events. ETFs, in particular, have structural features that allow for tax-efficient trading.

- Municipal bonds: Interest from these bonds is generally exempt from federal income tax and, in some cases, from state and local taxes if you reside in the issuing state. However, some municipal bond income may be subject to the alternative minimum tax [4] .

- Stocks held longer than one year: Long-term capital gains are usually taxed at a lower rate than short-term gains.

To implement this strategy:

- Review your current portfolio’s turnover rates and distribution history.

- Consider replacing high-turnover, actively managed funds in taxable accounts with index funds or ETFs.

- If you are in a high tax bracket, evaluate the potential benefits of municipal bonds versus taxable bonds.

As always, remember to align investment choices with your goals, time horizon, and risk profile. If you’re unsure which investment vehicles are right for you, most major brokerages offer educational tools and access to professional guidance.

Tax-Loss Harvesting: Turning Losses into Future Gains

Tax-loss harvesting is a strategy that involves selling investments at a loss to offset capital gains from other investments, thereby reducing your tax liability [2] . This can be especially useful in volatile markets or for investors with highly appreciated assets.

To implement tax-loss harvesting:

- Identify investments in your taxable accounts that are currently worth less than their purchase price.

- Sell these investments to realize the loss. The loss can be used to offset capital gains elsewhere in your portfolio, or up to $3,000 per year of ordinary income.

- Be aware of the “wash sale” rule, which prohibits you from repurchasing the same or a substantially identical investment within 30 days, or the loss will be disallowed.

- Consider investing the proceeds in a similar, but not identical, security to maintain your desired asset allocation.

Tax-loss harvesting can be complex, especially in larger or more active portfolios. Some financial advisors and robo-advisors offer automated tax-loss harvesting as part of their services.

Tax Bracket Management and Income Timing

Managing your taxable income can help you stay in a lower tax bracket or avoid triggering additional taxes, such as the Net Investment Income Tax. Strategies include:

- Roth conversions: Converting assets from a traditional IRA or 401(k) to a Roth IRA in low-income years can reduce future required minimum distributions (RMDs) and provide tax-free withdrawals in retirement.

- Strategic withdrawals: For those over age 59½, consider taking distributions before RMDs are mandatory to better control your taxable income each year.

- Harvesting gains in low-tax years: If you expect to be in a higher tax bracket in the future, realizing gains in a year with lower income might reduce your overall tax liability.

To implement these strategies:

- Estimate your income and tax bracket for the current and future years using IRS tax tables or online calculators.

- Coordinate Roth conversions and withdrawals with your overall financial plan.

- Consult a tax advisor or financial planner to optimize timing.

Income timing can be a powerful tool, but it requires careful planning and awareness of changing tax laws.

Common Challenges and Solutions

Tax-efficient investing involves ongoing monitoring and adjustment. Challenges can include keeping up with changing tax laws, managing complex portfolios with multiple account types, and avoiding “wash sale” or “kiddie tax” pitfalls. Here are some solutions:

- Work with a credentialed financial advisor or tax professional who stays current on tax law changes and can provide personalized advice.

- Use tax reporting tools and software offered by your brokerage to track cost basis, gains, and losses.

- Periodically rebalance your portfolio to maintain your desired asset allocation while also considering tax implications.

If you’re unsure where to start, you can contact a certified financial planner or search for IRS-registered tax professionals in your area. Most major brokerage firms also provide educational resources and access to advisors.

Alternative Approaches and Additional Considerations

Other tax-efficient strategies may include making charitable donations of appreciated assets (to avoid capital gains taxes), investing in qualified opportunity zones, or utilizing donor-advised funds. Each of these approaches comes with specific rules and may offer additional benefits for investors with particular goals.

To explore these strategies:

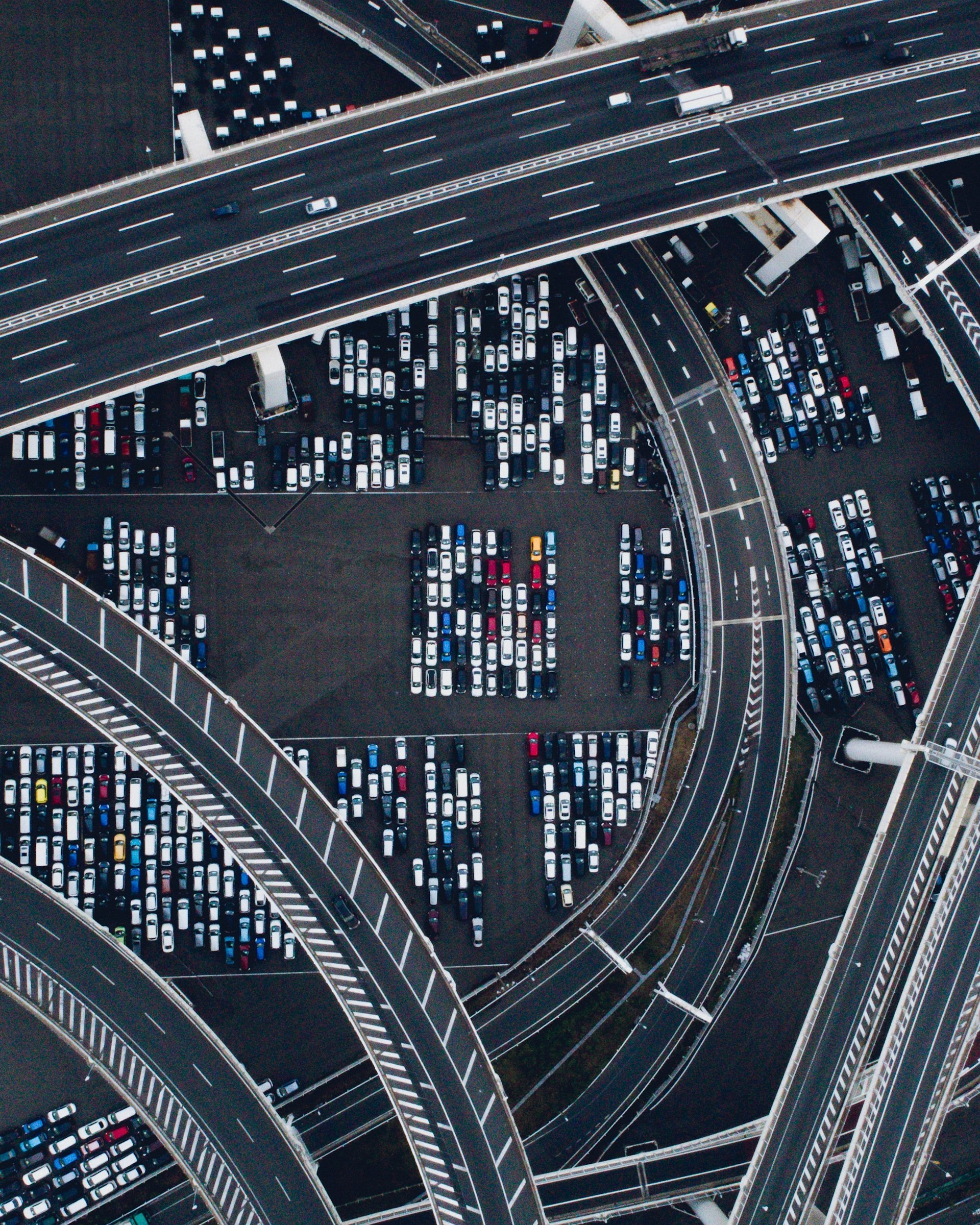

Photo by CHUTTERSNAP on Unsplash

- Search for “charitable giving of appreciated securities” on reputable financial institution websites.

- Consult the IRS or a tax advisor about opportunity zones and donor-advised funds.

Before implementing any advanced strategy, verify eligibility and potential impacts on your broader financial plan.

Key Takeaways and Next Steps

Tax-efficient investing is not a one-time activity but a continuous process that evolves with your financial situation and changes in tax law. By maximizing tax-advantaged accounts, strategically placing assets, choosing tax-efficient investments, harvesting losses, and managing your tax bracket, you can significantly enhance your after-tax returns. For tailored guidance, connect with a financial advisor or tax professional who can help you develop and implement a comprehensive plan.

References

[1] Mariner Wealth Advisors (2023). Three Strategies for Tax-Efficient Investing. [2] Ameriprise Financial (2023). 10 tax strategies for savvy investors. [3] Vanguard (2023). Effective tax-saving strategies for investors. [4] Edward Jones (2023). Tax-efficient investing for high-income earners. [5] Charles Schwab (2023). Tax-Efficient Investing: Why is it Important?