Unlocking the Future: Emerging Opportunities in Green Finance for Investors and Innovators

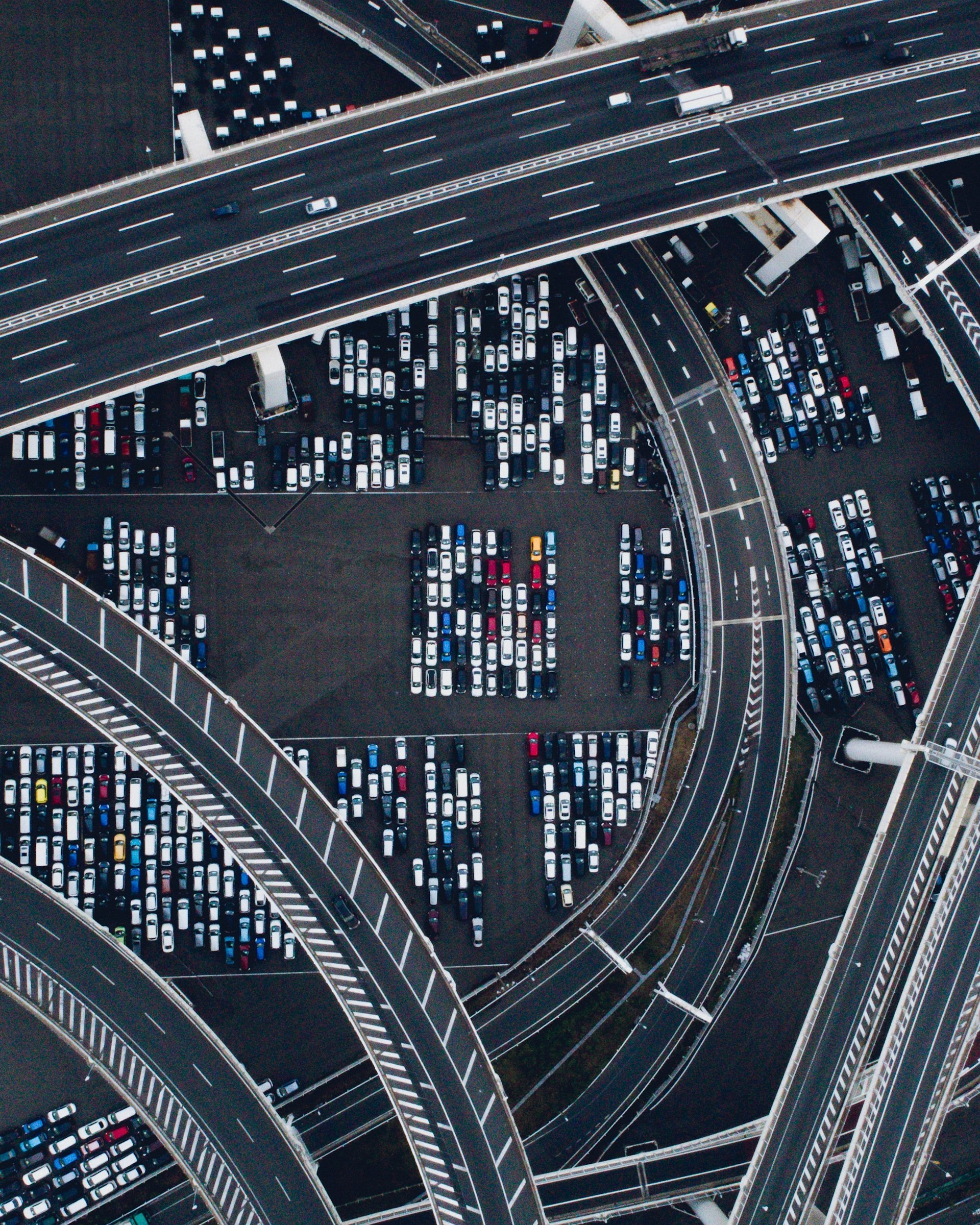

Photo by Talha Ramzan on Unsplash

Introduction: The Green Finance Revolution

As climate change intensifies and global policy accelerates toward net zero, green finance has emerged as a transformative force in the financial sector. Green finance refers to funding and investment strategies that prioritize environmental sustainability, including renewable energy, decarbonization, and climate resilience. This sector is evolving rapidly-powered by innovation, policy support, and growing investor demand-creating unprecedented opportunities for individuals, institutions, and entrepreneurs to participate in the transition to a low-carbon economy [1] .

Section 1: Innovative Financial Instruments Fueling Growth

Several new financial products are making it easier to channel capital into sustainable projects:

1. Green Bonds Green bonds enable governments, corporations, and institutions to raise funds specifically for environmentally friendly initiatives. In 2024, the global green bond market reached $600 billion, representing an 8% annual growth [1] . These bonds typically support renewable energy, clean transportation, and energy efficiency projects.

2. Sustainability-Linked Loans (SLLs) SLLs tie loan terms to the borrower’s progress on specific Environmental, Social, and Governance (ESG) goals. Borrowers receive lower interest rates when they meet sustainability targets, incentivizing climate action. Despite a recent dip, SLLs still reached $275 billion in the first half of 2024 [1] .

Photo by Shoeib Abolhassani on Unsplash

3. Voluntary Carbon Credits and Carbon Trading Organizations can offset their emissions by purchasing carbon credits, which fund verified emission reduction projects elsewhere. The voluntary carbon market is expanding as more companies embrace net-zero commitments and regulatory frameworks mature [3] .

4. Blended Finance Models Blended finance combines public and private capital to de-risk sustainable investments, especially in emerging markets. These models help attract private investors by leveraging government or development agency guarantees and grants [1] .

Section 2: Technological Innovation in Green Finance

Technology is redefining how capital is mobilized and tracked in green finance. Here’s how:

Blockchain for Transparency and Efficiency Blockchain technology enables transparent tracking of green bond issuance and use of proceeds, reducing fraud and administrative costs. Some platforms use blockchain to verify carbon credits, ensuring credibility for both buyers and sellers [3] .

Artificial Intelligence (AI) and Data Analytics AI-driven platforms can assess project risks, forecast climate impacts, and optimize investment portfolios for sustainability. They help investors identify high-impact opportunities while managing environmental risk factors [1] .

Case Study: The Green Asset Wallet, supported by several European financial institutions, uses blockchain to enhance the credibility and traceability of green investments, making it easier for investors to verify impact claims [3] .

Section 3: Expanding Global and Local Opportunities

Green finance is not limited to traditional financial centers. New opportunities are emerging worldwide:

1. Growth in Emerging Markets The Global Innovation Lab for Climate Finance has launched 78 new finance solutions, mobilizing $4.2 billion for climate investments in developing economies [2] . These solutions often focus on supporting entrepreneurs and small businesses tackling local climate challenges.

To access these opportunities, entrepreneurs and project developers can:

- Apply for technical support and funding through programs like the Global Innovation Lab for Climate Finance. Visit their official website and follow their application guidelines for upcoming cohorts.

- Partner with local development agencies, multilateral banks, or non-profits working on climate finance projects in your region.

- Research grant offerings from organizations such as the Climate Policy Initiative and major development banks.

2. Private Capital and Institutional Investment Private capital is now a critical source of funding for scalable climate solutions. Institutional investors are embedding sustainability into their core strategies, with major financial hubs like New York, London, and Singapore competing to lead the green finance movement [5] .

To get involved, investors should:

- Consult with financial advisors specializing in ESG and green finance products.

- Review green bond and ESG fund offerings from established asset managers and banks.

- Consider joining industry groups or attending conferences focused on sustainable investing for networking and education.

Section 4: Policy, Regulation, and Market Trends

Government incentives and evolving regulation are driving growth in green finance:

1. Tax Credits and Incentives Recent U.S. legislation, such as the Inflation Reduction Act, has expanded investment tax credits (ITC) and production tax credits (PTC) for renewable energy. The growing market for transferable tax credits is unlocking new capital for project developers [4] .

To access incentives:

- Consult the official Department of Energy or Internal Revenue Service (IRS) websites for guidance on renewable energy tax credits.

- Work with tax professionals experienced in sustainability-related incentives and credit transfers.

- Monitor regulatory updates in your jurisdiction to stay informed about new policies.

2. ESG Disclosure Requirements Many jurisdictions are introducing stricter ESG disclosure and reporting standards. This trend favors well-governed, transparent companies and creates new demand for professionals and solutions that facilitate ESG compliance [3] .

Firms can prepare by:

- Implementing systems for environmental data collection and reporting.

- Engaging third-party verifiers to validate sustainability claims.

- Staying updated on requirements from organizations like the SEC or the European Commission, depending on market presence.

Section 5: Careers and Capacity Building in Green Finance

The boom in green finance is opening new career paths for professionals with backgrounds in finance, sustainability, technology, and policy. Experts project the sustainable finance market could reach tens of trillions of dollars by the 2030s, creating demand for roles in project finance, ESG analysis, risk assessment, and climate advisory [5] .

To explore career opportunities:

- Seek out graduate programs or professional certificates in sustainable finance from recognized institutions.

- Leverage job boards and career services that specialize in climate, ESG, and impact investing roles.

- Build networks at industry events and through mentorship programs focused on sustainability.

Section 6: Implementation Challenges and Alternative Approaches

Entering or scaling within green finance can present challenges, including regulatory uncertainty, data gaps, and complexity in measuring environmental impact. However, several solutions exist:

Overcoming Barriers Stakeholders can mitigate risks by collaborating with experienced partners, investing in robust data infrastructure, and staying informed through reputable industry publications and official agency updates. Alternative approaches include participating in blended finance projects, leveraging emerging technologies for risk management, or investing in established ESG funds while building expertise.

Summary and Key Takeaways

Green finance is transforming how the world funds its climate ambitions. From innovative financial products and technology to growing global markets and new career paths, the sector offers actionable opportunities for investors, entrepreneurs, and professionals. To access these opportunities, stay informed through official sources, seek guidance from experienced advisors, and participate in programs and networks supporting sustainable finance. The journey to a sustainable future is underway, and green finance is your gateway to both impact and opportunity.

References

- Enable Green (2024). The Future of Green Finance: 2025 Trends.

- Climate Finance Lab (2025). 9 Solutions to Drive Sustainable Investments in Emerging Markets.

- 4IRE Labs (2025). Top 6 Green Finance Trends to Watch Out in 2025.

- J.P. Morgan (2025). Q1 2025 Carbon Transition & Sustainability Trends.

- Duke University Career Hub (2025). Green Finance: The Billion-Dollar Career Path You Might Not Have Considered.